Great Trades

Great stock trades based on fundamentals and technical analysis.Saturday, December 10, 2005

SFCC Opportunity

SFBC International, Inc. (SFCC), a drug development services company, provides a range of early and late stage clinical drug development services to branded pharmaceutical, biotechnology, generic drug, and medical device companies worldwide. The company has approximately 30 offices in North America, Europe, South America, India, and Australia.

SFBC has been a fast grower in this industry, as the company increased revenue and EPS by 184% and 34%, respectively in the first 9 months of this year. The pharmaceutical industry has shifted to outsourcing clinical trials, and SFBC is one of many firms that have benefited from this move. They pay thousands of patients nominal fees to participate in these clinical trials, which are a key part of getting FDA approval for new drugs.

On November 1, SFBC's stock, SFCC, closed at $41.49.On November 2, Bloomberg ran a scathing article about the ugly side of clinical trials, highlighting SFBC International in their industry profile: http://www.bloomberg.com/apps/news?pid=specialreport&sid=aspHJ_sFen1s&refer=news

The extensive article paints SFBC as a questionable outfit that takes advantage of poor immigrants to complete clinical trials for pharmaceutical clients. It also brought up conflicts of interest in the drug-testing industry, including a company paid to monitor the safety of participants in some of SFBC's clinical trials that was owned by the wife of an SFBC executive. In addition, it decries the fact that SFBC's Chairwoman, who got her M.D. from Sparta College in the Caribbean, is listed as a doctor in SEC filings, because she's never been licensed to practice medicine in the U.S. The article also mentions that SEC filings say SFBC CEO Arnold Hantman is a CPA, even though his CPA license expired in 1989 -- Hantman says he's been a lifetime member of the American Institute of CPA's. Finally, the story mentions efforts in Congress to "guarantee the safety of clinical research." Senator Charles Grassley (R., Iowa), has led the charge against the industry.

On November 3, SFCC sold off to as low as $27.64 in reaction to this article, losing over 1/3 of its value. In the next 2 weeks, SFCC rallied back as high as $33.80 as the company tried to control the damage from the article both in a conference call and a letter on their web site refuting Bloomberg's claims: http://www.sfbci.com/downloads/Dear%20Friends.pdf.

On November 16, Bloomberg ran a second article, this time accusing SFBC officials, including the CEO, of threatening 3 Latin American immigrants with calling "the U.S. Department of Homeland Security to have the participants deported if they didn't sign statements refuting a Bloomberg News story published Nov. 2": http://www.bloomberg.com/apps/news?pid=specialreport&sid=aF3ZWezawt5k&refer=news

In their damage control effort, SFBC hosted a conference call and webcast to respond to the articles and recent stock activity, during which the CEO flatly denied the allegations. Despite these efforts, doubt had set in among investors, and in the next 2 weeks, SFCC sold off as low as 20.81, losing over 1/3 of its already discounted price.

On December 1, SFBC took yet another hit, as Miami-Dade county officials raised concerns about the fire exits and structural issues at its Miami headquarters and clinical facility: http://biz.yahoo.com/bizj/051201/1197710.html?.v=2

The company said the structural issue arose when it had interior walls removed to create larger work areas. The facility was formerly a motel and later an assisted-living center. SFBC reduced the number of beds at the facility to 350 from 675, and expected to also relocate 120 more beds to another building it owns in Miami. Though the inspectors allowed SFBC to continue its operations, and management said it believes the reduction of beds at the facility will not have a material adverse effect on the company, the already doubt-ridden stock got clobbered again with panic selling from the remaining shareholders. That day, the stock cascaded down to $15.39, over 25% lower yet than the low after the previous selloffs.

On December 2, SFBC announced plans to "ensure its ability to conduct business with no material impact as to future revenue or net income. In addition, SFBC's lenders demonstrated their confidence in the Company by amending the credit facility to allow SFBC to spend up to $30 million on repurchasing shares of its common stock on the open market." Investment firm Robert W. Baird also upgraded the stock from "Neutral" to "Outperform" with the following notes:

"Any Way We Slice It, We Believe SFCC Shares Are Undervalued. On our new estimates, SFCC is trading at 8.3x CY06 EPS of $1.86, a 54% discount to the Baird CRO Index's 18.0x and a 6.5x CY05E EV/EBITDA, or a 40% discount to the Baird CRO Index's 10.8x. We suggested earlier in this report that in a potential worst-case scenario, total elimination of Miami facility operations(which encompasses more than just Phase I) may cause as much as a 30% reduction in earnings, which applied to our previous $2.32 estimate suggests roughly $1.62 in potential 2006 EPS. Applying an industry-low P/E multiple of 10x would suggest downside to roughly $16, which SFCC shares have reached. We also note SFCC's market cap now stands at roughly $290M, just slightly above the $250M SFCC paid for PharmaNet in 2004, which represents roughly 50% of the company's operations. Finally, SFCC shares are trading near book value (as of 3Q05-end, book value per share stood at $16)."

On December 5, SFCC shares rebounded as high as $19.70 after the Baird upgrade and company assurance that there would be no material impact from the latest news, along with SFBC's hiring of a Chicago-based law firm to assist their existing counsel "to conduct an independent review of issues raised about the company in recent articles." Since then, SFCC has consolidated in a range between $17.19 and $19.70.

For subscribers to Realmoney.com (available free to clients of some brokers such as Harris Direct), there's a very good article by Jonathan Moreland on December 5 entititled, "Taking the Long-Side of This Battle." It discusses this situation in greater detail and outlines the risks involved in buying SFCC shares after the big selloffs. Moreland posits:

"The major question to ask yourself about whether to try your luck with this stock at this point is simple: Has SFBC systematically broken laws and industry regulations that knowingly put subjects at risk? If you believe so, stay away. But if you believe that any transgressions by the company stemmed from a few bad-apple employees and that the stock already has overreacted to any likely penalties, you realize the stock is a calculated risk, and you may want to take it."

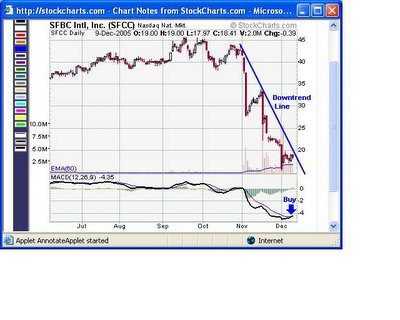

MACD Buy Signal

MACD, or Moving Average Convergence/Divergence, "is one of the simplest and most reliable indicators available." You can find out all about MACD here: http://stockcharts.com/education/IndicatorAnalysis/indic_MACD1.html

SFCC's chart got a clear MACD buy signal Friday, as the thicker MACD line crossed up over the thinner 9-day EMA trigger line at a severely depressed level at around -5:

While not a sure thing by itself, this MACD buy signal combined with a good bottoming candlestick on the weekly chart and oversold RSI, along with very cheap fundamentals, indicate a strong rebound is likely. The record volume on the climactic selloff to $15.39 on December 1 also indicate that was capitulation panic selling and should mark the bottom for SFCC, at least for now. The downtrend line should be broken to the upside this week, confirming the buy signal and clearing the way for a rebound.

While not a sure thing by itself, this MACD buy signal combined with a good bottoming candlestick on the weekly chart and oversold RSI, along with very cheap fundamentals, indicate a strong rebound is likely. The record volume on the climactic selloff to $15.39 on December 1 also indicate that was capitulation panic selling and should mark the bottom for SFCC, at least for now. The downtrend line should be broken to the upside this week, confirming the buy signal and clearing the way for a rebound.Conclusion

Bloomberg’s negative press and serious accusations will likely affect SFBC’s operations regardless of the outcome of the independent review. However, it seems the worst case scenario has been priced in to SFCC shares, which remain over 50% lower than the $41.49 November 1 close, and only about $2 above book value. If the independent review clears SFBC’s name, even if it results in the firing of the CEO and other employees who may have participated in questionable activities, SFCC shares should rebound significantly. Uncertainty and doubt has left SFCC shares depressed, but once that uncertainty is lifted, buyers should flock to the stock if the result isn’t devastating. If Congress takes on the industry, it would affect SFBC’s competitors as much as them. However, shares of SFBC competitors Pharmaceutical Product Development (PPDI) and Covance (CVD) have not been affected by the Bloomberg articles at all, as both are above where they were on November 1.

In any case, technical analysis indicates that a calculated risk buy at currently depressed levels of SFCC shares will likely be rewarded with a significant rally. There are many cases in the past of stocks that have taken significant hits from negative press, only to rebound and handsomely reward buyers who took advantage of the selloff opportunity. The coming weeks and months will show whether that will be the case once again.

Archives

December 2005 January 2006 February 2006 March 2006 April 2006 May 2006 July 2006 August 2006 October 2006 November 2006 December 2006 January 2007 February 2007 March 2007 April 2007 May 2007 June 2007 August 2007 October 2007 November 2007 May 2008 September 2008 October 2008 January 2009 February 2009 March 2009 April 2009 May 2009 June 2009 July 2009 August 2009 September 2009 October 2009 November 2009 December 2009 March 2010 May 2010 June 2010

Great Trades Home Email GreatTrades

Great Investments Blog Great Investment Articles BlogDisclaimer: Great Trades may have a position in all or some of the stocks discussed in this blog, but is not paid by any company to promote their stock. Great Trades contains opinions, none of which constitute a recommendation that any particular security, transaction, or investment strategy is suitable for any specific person. Great Trades does not provide personalized investment advice.