Great Trades

Great stock trades based on fundamentals and technical analysis.Thursday, December 29, 2005

QDEL Short Opportunity -- Don't Fall for the Hype

Basically, this news means that QDEL can update their package insert on their flu test product. On this rather insignificant news, the stock has run up from under 9.5 to over 12. Part of the reason for the big runup today is misleading reporting, with inaccurate headlines like "FDA gives Quidel's flu-test kit the green light."

Technically, QDEL broke its steep uptrend on its weekly chart earlier this month. It had ridden the bird flu hype from the 3's in April to almost 16 last month, even though they only sell a flu test, not a cure. A MACD sell signal on the weekly chart triggered, indicating the run was over and the stock should return to much lower levels. Today's misguided rally retested that uptrend line, and provides a good opportunity to sell for those still holding the stock, or to short for those inclined to take that kind of risk. A short anywhere near 12 or above should be well rewarded in coming weeks. The stock is likely to sell off several points from this rally once the hype subsides.

Thursday, December 22, 2005

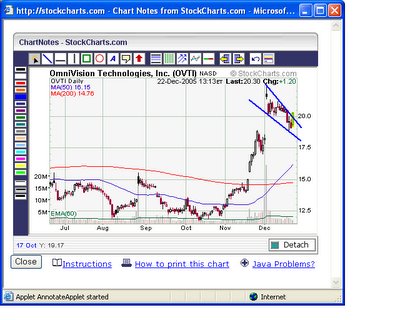

OVTI Breakout from Bull Flag

In addition to the longer term Golden Cross buy signal mentioned before, OVTI triggered a shorter term buy signal today by breaking out from the bull flagg formed during the consolidation over the past 3 weeks. It also broke back above the 20 support level that broke earlier this week, after filling the gap left after the earnings report. You can read more about bull flags here:

In addition to the longer term Golden Cross buy signal mentioned before, OVTI triggered a shorter term buy signal today by breaking out from the bull flagg formed during the consolidation over the past 3 weeks. It also broke back above the 20 support level that broke earlier this week, after filling the gap left after the earnings report. You can read more about bull flags here:http://www.chartpatterns.com/flagsandpennants.htm

Positive comments from Jefferies helped move the stock higher today. Here's what they said, from Briefing.com:

07:15 OVTI OmniVision: Micron's positive outlook likely bodes well for Co and camera phone supply chain - Jefferies (19.10 )

Jefferies believes Micron's (MU 14.14) revenue growth and guidance for its CMOS image sensor business, as well as its positive comments regarding the state of the camera phone market, are a positive for both OVTI and the entire camera phone supply chain. OVTI guided rev growth of only 3-5% Q/Q for its Jan. qtr. ($130-140MM), which they believe may be conservative since it will likely benefit from the atypical seasonal strength that MU is experiencing in the camera phone mkt. Therefore, the firm states that is likely that OTVI should achieve the high end of the range, if not exceed it.

After their blowout earnings report, along with the high short interest, improving fundamentals, and technical buy signals, OVTI looks poised to move higher over coming months.

Thursday, December 15, 2005

WPCS, SFCC Removed from List

With today's gap up to the 20 area (over 21 premarket) and ensuing technical failure after allegations were raised on the conference call and some more questions were raised in yet another Bloomberg article (http://www.bloomberg.com/apps/news?pid=specialreport&sid=a90OZzPRlkaE&refer=news), I'm removing SFCC from my list. I may add it back after the issues are cleared up and the technicals look better.

Updates

With today's breakdown, SFCC should be avoided until the allegations raised today are cleared and the chart setup improves.

WPCS blew out their earnings report, reporting .20 vs. .02 a year ago for 1000% growth. The stock rallied as high as 9.62, up almost 2 from yesterday, providing a good selling opportunity with the extended technicals. A good pullback will be a good buying opportunity to reacquire shares for the long run.

SFCC Update

The detailed Independent Cousel report is here: http://www.sfbci.com/sfbc/upload/sfbc/banniere/sfbcrept.pdf.

Here's Briefing.com's take on the revised guidance:

06:02 ET SFBC Intl sees FY05 non-GAAP EPS of $1.88-1.93 vs $1.82 consensus; revs of $329-330.5 mln vs $350.7 consensus (SFCC) 17.66 :SFCC sees 2005 non-GAAP EPS $1.88-1.93 vs $1.82 consensus; sees revs of $329-330.5 mln vs $350.7 mln consensus. The co's EPS and non-GAAP EPS guidance includes legal and related expenses pertaining to the Bloomberg articles of approximately $0.03 per share. In addition, the co has identified approximately $0.02 in lost EPS as a direct result of one client canceling two signed contracts of ongoing studies due to the Bloomberg articles, the impact of which is included in guidance. Non-GAAP EPS excludes non-cash expenses of approximately $0.18 per fully diluted share related to amortization of intangibles and $0.14 per fully diluted share related to one-time write-offs of deferred financing costs. Co sees 2006 non-GAAP EPS of $1.93-1.99 vs $1.90 consensus; revs of $355-363 mln vs $377.4 mln consensus. Non-GAAP EPS excludes non-cash expenses of approximately $0.13 per fully diluted share related to amortization of intangibles.

Wednesday, December 14, 2005

Updates

Another stock that may be good for a rally is CUTR. Cutera, Inc. (CUTR) engages in the design, development, manufacture, and marketing of various products for use in laser and other light-based aesthetic applications. Its products enable dermatologists, plastic surgeons, gynecologists, primary care physicians, and other practitioners to offer noninvasive aesthetic treatments to their patients. After ranking #1 on Investors Business Daily's IBD 100 list of top stocks this weekend, CUTR lost over 34% yesterday after news was released about a federal judge denying their motion for summary judgment in Palomar Medical Technologies' patent lawsuit against them. Most summary judgments are denied, as they would immediately end the case and this one would have invalidated Palomar's patent, but CUTR shareholders panicked anyway. This 4-year old case will likely drag on for a few more years with a jury trial likely in the spring followed by appeals. I think the big selloff was an overreaction and CUTR will get a retracement rally today. You can see from the chart that CUTR dropped right to its 100-day moving average, which should provide support for a bounce.

Tuesday, December 13, 2005

CNTF for the Long Term

These results mean that CNTF at $14.48 is trading at a PE of 15.6 (or lower) for earnings growth of 100%+. That's an incredible bargain, as that growth justifies a much higher multiple. Considering that this is a Chinese stock in a hot sector, CNTF could easily trade at an above average multiple.

I listened to the earnings call, a replay of which you can listen to at http://www.techfaithwireless.com/. There's also a pdf file with their earnings presentation there. The transcript of the call is available here: http://chinastockblog.com/article/4507. I was impressed that they are planning huge growth over the next year. Currently, they have about 2000 employees, and are planning to grow to 3400 employees by the end of 2006. In the Q&A session (transcript here: http://chinastockblog.com/article/4508), the president said "for revenue, 2006, we hope we can have 100% increase... Year-on-year, 100% increase." Even if they only grow revenue by 20%, CNTF is undervalued, but if they grow revenue 100%, the stock will be several times higher next year. This isn't a tiny company, which you usually find in a company reporting earnings growth this huge. This company has a market cap of over $500 million, so it has more analyst coverage and institutional involvement than much smaller companies.

When CNTF was trading higher than current levels on the way up to the $18.80 high, Kaufman Brothers issued the following upgrade on CNTF:

CNTF China Techfaith Wireless tgt raised to $18.50 from $15 at

Kaufman Bros (14.76 )

Yesterday, China TechFaith hosted its first Analyst and Investor Meeting in

Beijing, China that was available via webcast. On the back of this meeting,

firm raising its 12-month price target to $18.50 (18x 2006 est of $1.01)

from $15. In firm's view, China TechFaith is the best positioned of any ODP

(original design provider) to benefit from the planned issuance of 3G

licenses in China with capabilities in WCDMA/UMTS and CDMA 2000 EVDO

technologies, while also developing TD-SCDMA capabilities. Kaufman believes

that as investors become more comfortable with mgmt and begin to more fully

appreciate the exceptional profit and growth characteristics of China

TechFaith's business model (that firm believes is still in the embryonic

stages of some very powerful long-term secular trends), Kaufman believes

co's P/E multiple will expand. Despite the sharp rally in the shares over

the past week (up approx 70%) from very depressed levels and the potential

for some profit taking, Kaufman believes the stock will move higher before

the year is finished.

If you look at a chart of CNTF, it came public in the U.S. in May in the $16 area, rallied to near $20, and then sold off in August, hitting a low of under $8 in October. It spent a couple of months forming a trading range between around $8 and $11 and then after the earnings report broke out of this trading range and rallied as high as $18.80 before pulling back to its current $14.48 price. Part of the selloff was spurred on by stock commentator Jim Cramer saying he wouldn't buy CNTF because he only likes one Chinese company. Cramer tends to blow off stocks he doesn't know in favor of his favorites.

Yesterday, CNTF hit a low of $14, a technical support area and nearly a 50% retrace of the earnings rally (a typical support level). It also rallied back to close down just .12, printing a pretty good bottoming candlestick. The Point & Figure chart shows a target of $29.00:

http://stockcharts.com/def/servlet/SC.pnf?chart=cntf,PLTADANRBO[PA][D20051212][F1!3!!!2!20]&pref=G

CNTF in the $14's should be a great buy for the long term.

Monday, December 12, 2005

ORCT -- Bull Pennant in an Uptrend

Orckit Communications (ORCT) is an Israeli company that sells communications equipment internationally. Since transitioning to focus on "Triple Play" communications gear, which allows a service provider (i.e., telecomm or cable) to offer voice, data, and video together across networks, they've only had 1 main customer, KDDI in Japan. Here's a businessweek article discussing how the "Triple Play" is the big trend in the industry: http://yahoo.businessweek.com/investor/content/nov2005/pi2005114_7121_pi044.htm

In July, ORCT fell from over $28 after guiding Q3 EPS to .23 vs. analyst estimates of .25. It broke its uptrend and subsequently drifted down to the 20 area ahead of the Q3 report. On 10/21, it broke 20 support and on 10/24 made a new low at 17.77. After a bounce, on Thursday, 10/27, ORCT broke that new 17.77 support, triggering stops and massive selling. Rumors circulated about them losing their one customer, Israel being attacked by Iran, or them missing EPS badly. On record volume of over 3.5 million shares, ORCT sold down as low as 12.22, $7 below the previous close. In retrospect, that was a climactic, capitulation panic selloff.

On Monday morning, 10/31, ORCT announced blowout earnings of .30 (excluding a one-time capital gain), well above what analysts had predicted before the selloff from over $28. In addition, they mentioned they had begun shipments to a U.S. telecom carrier, though no revenues were included in the Q3 report. Also, they upped Q4 guidance to .41 vs. .33 estimates, resulting in full year guidance of $1.11 (excluding the one-time gain). They upped 2006 guidance to $1.50, more than 35% growth over 2005. On the conference call, they indicated that these numbers were based only on existing customers, and any new customers would be addtional to these estimates. They also hinted at several potential new customers, particularly in Asia. Finally, they announced that they'd paid off all of their debt.

So ORCT dropped from $28+ down to $12.22 after disappointing guidance, and subsequently blew out the original estimates while mentioning a new U.S. customer (not yet formally announced separately nor reflected in earnings) and upping guidance significantly, yet the stock still sits under $24, almost 20% lower than before all of this improvement in fundamentals. With the capitulation selloff behind it and fundamentals pointing to a much higher price, ORCT looks like a tremendous bargain. Even a conservative 30 PE on 2006 earnings for the 35% growth would put ORCT at $45. Any new customers would increase those numbers. With a recent history of being very conservative on guidance and then blowing out estimates, ORCT has huge upside.

Many analysts from many firms were on the earnings call, but only one (RBC's Daniel Meron) had been covering it, with a $34 target. Recently, CE Unterberg Towbin initiated coverage with a Buy rating and a $30 target and the high-profile Oberweiss newsletter added ORCT as a Buy in its December issue.

Bull Pennant

After ORCT blew out earnings and upped guidance on 10/31, the stock consolidated in a bull flag pattern for a month before breaking out from that pattern at the begining of this month. Last week Monday, ORCT rallied to a high of $24.90, well above the upper Bollinger Band (22.64 at the time), so it spent the rest of the week consolidating the breakout in a bull pennant pattern.

You can find out more about flags and pennants here:

http://www.chartpatterns.com/flagsandpennants.htm

Currently, ORCT is poised for another rally after consolidating well within the Bollinger Bands. As of Friday, the upper Bollinger Band was continuing higher and stood at $24.55, allowing plenty of room for the stock to continue its climb higher. The 9-day EMA (Exponential Moving Average) should also act as support as ORCT trends up. A breakout from the bull pennant should mark the beginning of the next leg up. The Point & Figure chart points to a target of $41.50: http://stockcharts.com/def/servlet/SC.pnf?c=orct,P.

Sunday, December 11, 2005

WPCS International Earnings This Week

With earnings guidance for the year of .58 a share, WPCS has a PE of 13, a tiny 2.6 million share float, and a $29.2 million market cap, WPCS has huge potential upside.

WPCS is expected to report earnings by this Thursday, December 15. If momentum traders get ahold of WPCS on a good report as they have with other low float stocks recently, it could take off. If not, WPCS looks like a great buy and hold stock in the early stages of growth.

Saturday, December 10, 2005

OVTI Consolidating After Blowout Earnings Gap

On December 1, behind strong demand from mobile handset manufacturers, OVTI blew away earnings estimates for their fiscal Q2 2006, reporting .41 EPS, .10 above analyst estimates of .31 and vs. .28 a year earlier. They reported revenue of $126.8 million vs. estimates of $114.6 million and last year's $84.4 million. They also increased guidance for this quarter to .42-.47 on revenue of $130 million to $140 million. vs. estimates of .33 on revenue of $118 million. As part of their board-authorized $100 million stock repurchase program, they purchased 4,620,000 shares at an average cost of $13.51 per share, a smart use of their excess cash.

That day, the stock gapped up from $18.25 to $21.78 and rallied to $22.49 before selling back to close at $21.56, all on huge volume of over 24 million shares. The upper Bollinger Band, which tends to contain the trading of the stock, was at $20.48, so the stock was technically very extended. To relieve this extended situation, the stock spent all of last week consolidating between $20.08 and $21.34. This consolidation near the highs after a big gap up is very bullish for the stock, and sets it up for another rally. On Friday, the upper Bollinger Band stood at $22.69, giving the stock plenty of upside without getting extended.

OVTI has a huge short interest, with over 20 million shares reported short as of 11/10, or over 40% of the float. The shorts have been all over OVTI since they had an SEC inquiry (that OVTI themselves initiated) last year that resulted in them restating their earnings higher than previously stated and no wrongdoing found. Herb Greenberg of CBS Marketwatch and Jeffries analyst Benjamin have led the short brigade with their criticisms and doubts about OVTI, which now appear to have been unwarranted. Despite the blowout report, these critics continued to bash OVTI, saying that something "smelled fishy," which indicated that they had nothing concrete to use against OVTI. Greenberg said he'd report back after he sees the 10Q filing, which is due out by 12/15.

On Monday, 12/5, JP Morgan came out with a note saying the stock is "still mis-priced, in our view" at "12.2 times revised FY06E EPS, a 55% discount to the mean of our coverage universe. 12.2 times earnings for a stock with 40% short interest and 20%+ EPS growth expected for the next 5 years is a recipe for a strong short squeeze rally.

Golden Cross

OVTI just triggered a "Golden Cross" buy signal:

http://www.changewave.com/Glossary.html "A golden cross is a trading tool that indicates a buying trend is in place. A golden cross occurs when the 50-day moving average of a stock breaks above (crosses) the 200-day moving average. This technical indicator tells you that there are currently more people buying than selling the stock than in the past. Technical analysts believe a golden cross usually means it is safe to buy a stock and it will continue to rise."

With its discounted valuation, the huge short interest, the "Golden Cross," and the consolidation near its recent highs, OVTI looks like a great buy at current levels (closed Friday at $20.70) for a significant rally or a long-term hold. Conservative investors can use a stop loss if the 20 support area is lost to protect capital.

With its discounted valuation, the huge short interest, the "Golden Cross," and the consolidation near its recent highs, OVTI looks like a great buy at current levels (closed Friday at $20.70) for a significant rally or a long-term hold. Conservative investors can use a stop loss if the 20 support area is lost to protect capital.SFCC Opportunity

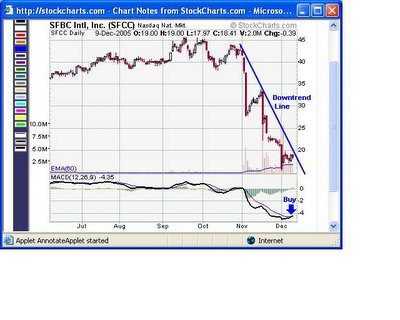

SFBC International, Inc. (SFCC), a drug development services company, provides a range of early and late stage clinical drug development services to branded pharmaceutical, biotechnology, generic drug, and medical device companies worldwide. The company has approximately 30 offices in North America, Europe, South America, India, and Australia.

SFBC has been a fast grower in this industry, as the company increased revenue and EPS by 184% and 34%, respectively in the first 9 months of this year. The pharmaceutical industry has shifted to outsourcing clinical trials, and SFBC is one of many firms that have benefited from this move. They pay thousands of patients nominal fees to participate in these clinical trials, which are a key part of getting FDA approval for new drugs.

On November 1, SFBC's stock, SFCC, closed at $41.49.On November 2, Bloomberg ran a scathing article about the ugly side of clinical trials, highlighting SFBC International in their industry profile: http://www.bloomberg.com/apps/news?pid=specialreport&sid=aspHJ_sFen1s&refer=news

The extensive article paints SFBC as a questionable outfit that takes advantage of poor immigrants to complete clinical trials for pharmaceutical clients. It also brought up conflicts of interest in the drug-testing industry, including a company paid to monitor the safety of participants in some of SFBC's clinical trials that was owned by the wife of an SFBC executive. In addition, it decries the fact that SFBC's Chairwoman, who got her M.D. from Sparta College in the Caribbean, is listed as a doctor in SEC filings, because she's never been licensed to practice medicine in the U.S. The article also mentions that SEC filings say SFBC CEO Arnold Hantman is a CPA, even though his CPA license expired in 1989 -- Hantman says he's been a lifetime member of the American Institute of CPA's. Finally, the story mentions efforts in Congress to "guarantee the safety of clinical research." Senator Charles Grassley (R., Iowa), has led the charge against the industry.

On November 3, SFCC sold off to as low as $27.64 in reaction to this article, losing over 1/3 of its value. In the next 2 weeks, SFCC rallied back as high as $33.80 as the company tried to control the damage from the article both in a conference call and a letter on their web site refuting Bloomberg's claims: http://www.sfbci.com/downloads/Dear%20Friends.pdf.

On November 16, Bloomberg ran a second article, this time accusing SFBC officials, including the CEO, of threatening 3 Latin American immigrants with calling "the U.S. Department of Homeland Security to have the participants deported if they didn't sign statements refuting a Bloomberg News story published Nov. 2": http://www.bloomberg.com/apps/news?pid=specialreport&sid=aF3ZWezawt5k&refer=news

In their damage control effort, SFBC hosted a conference call and webcast to respond to the articles and recent stock activity, during which the CEO flatly denied the allegations. Despite these efforts, doubt had set in among investors, and in the next 2 weeks, SFCC sold off as low as 20.81, losing over 1/3 of its already discounted price.

On December 1, SFBC took yet another hit, as Miami-Dade county officials raised concerns about the fire exits and structural issues at its Miami headquarters and clinical facility: http://biz.yahoo.com/bizj/051201/1197710.html?.v=2

The company said the structural issue arose when it had interior walls removed to create larger work areas. The facility was formerly a motel and later an assisted-living center. SFBC reduced the number of beds at the facility to 350 from 675, and expected to also relocate 120 more beds to another building it owns in Miami. Though the inspectors allowed SFBC to continue its operations, and management said it believes the reduction of beds at the facility will not have a material adverse effect on the company, the already doubt-ridden stock got clobbered again with panic selling from the remaining shareholders. That day, the stock cascaded down to $15.39, over 25% lower yet than the low after the previous selloffs.

On December 2, SFBC announced plans to "ensure its ability to conduct business with no material impact as to future revenue or net income. In addition, SFBC's lenders demonstrated their confidence in the Company by amending the credit facility to allow SFBC to spend up to $30 million on repurchasing shares of its common stock on the open market." Investment firm Robert W. Baird also upgraded the stock from "Neutral" to "Outperform" with the following notes:

"Any Way We Slice It, We Believe SFCC Shares Are Undervalued. On our new estimates, SFCC is trading at 8.3x CY06 EPS of $1.86, a 54% discount to the Baird CRO Index's 18.0x and a 6.5x CY05E EV/EBITDA, or a 40% discount to the Baird CRO Index's 10.8x. We suggested earlier in this report that in a potential worst-case scenario, total elimination of Miami facility operations(which encompasses more than just Phase I) may cause as much as a 30% reduction in earnings, which applied to our previous $2.32 estimate suggests roughly $1.62 in potential 2006 EPS. Applying an industry-low P/E multiple of 10x would suggest downside to roughly $16, which SFCC shares have reached. We also note SFCC's market cap now stands at roughly $290M, just slightly above the $250M SFCC paid for PharmaNet in 2004, which represents roughly 50% of the company's operations. Finally, SFCC shares are trading near book value (as of 3Q05-end, book value per share stood at $16)."

On December 5, SFCC shares rebounded as high as $19.70 after the Baird upgrade and company assurance that there would be no material impact from the latest news, along with SFBC's hiring of a Chicago-based law firm to assist their existing counsel "to conduct an independent review of issues raised about the company in recent articles." Since then, SFCC has consolidated in a range between $17.19 and $19.70.

For subscribers to Realmoney.com (available free to clients of some brokers such as Harris Direct), there's a very good article by Jonathan Moreland on December 5 entititled, "Taking the Long-Side of This Battle." It discusses this situation in greater detail and outlines the risks involved in buying SFCC shares after the big selloffs. Moreland posits:

"The major question to ask yourself about whether to try your luck with this stock at this point is simple: Has SFBC systematically broken laws and industry regulations that knowingly put subjects at risk? If you believe so, stay away. But if you believe that any transgressions by the company stemmed from a few bad-apple employees and that the stock already has overreacted to any likely penalties, you realize the stock is a calculated risk, and you may want to take it."

MACD Buy Signal

MACD, or Moving Average Convergence/Divergence, "is one of the simplest and most reliable indicators available." You can find out all about MACD here: http://stockcharts.com/education/IndicatorAnalysis/indic_MACD1.html

SFCC's chart got a clear MACD buy signal Friday, as the thicker MACD line crossed up over the thinner 9-day EMA trigger line at a severely depressed level at around -5:

While not a sure thing by itself, this MACD buy signal combined with a good bottoming candlestick on the weekly chart and oversold RSI, along with very cheap fundamentals, indicate a strong rebound is likely. The record volume on the climactic selloff to $15.39 on December 1 also indicate that was capitulation panic selling and should mark the bottom for SFCC, at least for now. The downtrend line should be broken to the upside this week, confirming the buy signal and clearing the way for a rebound.

While not a sure thing by itself, this MACD buy signal combined with a good bottoming candlestick on the weekly chart and oversold RSI, along with very cheap fundamentals, indicate a strong rebound is likely. The record volume on the climactic selloff to $15.39 on December 1 also indicate that was capitulation panic selling and should mark the bottom for SFCC, at least for now. The downtrend line should be broken to the upside this week, confirming the buy signal and clearing the way for a rebound.Conclusion

Bloomberg’s negative press and serious accusations will likely affect SFBC’s operations regardless of the outcome of the independent review. However, it seems the worst case scenario has been priced in to SFCC shares, which remain over 50% lower than the $41.49 November 1 close, and only about $2 above book value. If the independent review clears SFBC’s name, even if it results in the firing of the CEO and other employees who may have participated in questionable activities, SFCC shares should rebound significantly. Uncertainty and doubt has left SFCC shares depressed, but once that uncertainty is lifted, buyers should flock to the stock if the result isn’t devastating. If Congress takes on the industry, it would affect SFBC’s competitors as much as them. However, shares of SFBC competitors Pharmaceutical Product Development (PPDI) and Covance (CVD) have not been affected by the Bloomberg articles at all, as both are above where they were on November 1.

In any case, technical analysis indicates that a calculated risk buy at currently depressed levels of SFCC shares will likely be rewarded with a significant rally. There are many cases in the past of stocks that have taken significant hits from negative press, only to rebound and handsomely reward buyers who took advantage of the selloff opportunity. The coming weeks and months will show whether that will be the case once again.

MVCO Cup & Handle Breakout

MVCO had a clear breakout from its Cup & Handle pattern on Thursday. Below is an illustration of this chart:

The depth of the right side of the cup is a little over 5 points. That means the target of this pattern is around 17-17.50. We'll see if this pattern works over the coming weeks and months. The fundamentals as desribed below certainly support such a move.

From 11/8/05:

MVCO's blowout report justifies a much higher price. They reported .60 per share, a $20/share sales backlog, over $25 million cash, and have increased working capital from $1.8 million a year ago to over $20 million now. Based on the fundamentals, this stock should be well over $20. With the average PE for the industry around 27, and some much higher (http://finance.yahoo.com/q/in?s=MVCO), you could argue MVCO should be worth 27 times annualized $2.40 EPS, or over $64 a share. Even if you assume future quarters will only be half as good as this quarter, that would still be $1.50 in earnings for the year, which should justify a $40.50 price with a 27 PE. As a turnaround story, it could take a couple more quarters of great results for MVCO to completely earn investors' confidence and get to a more appropriate valuation, but the turnaround started with last quarter's great report, making this 2 stellar reports indicating a strong turnaround.

If Toll Brothers hadn't warned this morning, sending everything related to housing and construction down big, MVCO would have done much better. It probably would have held the early $12 level, and then run further on the technical breakout. As it is, it didn't hold that level after the Toll Brothers warning, so daytraders and short-term traders exited, sending it down below $11. While the fundamentals point much higher, the technicals pointed to a selloff.

MVCO's earnings reaction today was much like GOOG's reaction to past earnings reports. Several times, GOOG announced stellar earnings, only to sell down from the gap as short-term traders exited. It then moved up strongly after that as the fundamentals took over. If you had bought GOOG at the high the day after earnings in April, you'd have felt pretty bad by the end of the day when you were down over $8. However, if you waited until today to sell, you'd have been up over $170.

In the long run, the fundamentals win out. I think MVCO will be much higher in coming months. The weekly chart looks poised for a great breakout, and the Point & Figure chart shows a target of $21.50:

http://stockcharts.com/def/servlet/SC.pnf?chart=mvco,PLTADANRBO[PA][D][F1!3!!!2!20]&pref=G

Now, if the real estate market or the stock market crash in coming months, that could put a damper on the MVCO story. MVCO is in the construction industry, with 2 business segments -- construction services and construction materials (through their Ready Mix concrete subsidiary). To me, MVCO represents a great risk/reward investment in the $10-12 area, but as always, plese remember to be careful...

Archives

December 2005 January 2006 February 2006 March 2006 April 2006 May 2006 July 2006 August 2006 October 2006 November 2006 December 2006 January 2007 February 2007 March 2007 April 2007 May 2007 June 2007 August 2007 October 2007 November 2007 May 2008 September 2008 October 2008 January 2009 February 2009 March 2009 April 2009 May 2009 June 2009 July 2009 August 2009 September 2009 October 2009 November 2009 December 2009 March 2010 May 2010 June 2010

Great Trades Home Email GreatTrades

Great Investments Blog Great Investment Articles BlogDisclaimer: Great Trades may have a position in all or some of the stocks discussed in this blog, but is not paid by any company to promote their stock. Great Trades contains opinions, none of which constitute a recommendation that any particular security, transaction, or investment strategy is suitable for any specific person. Great Trades does not provide personalized investment advice.