Great Trades

Great stock trades based on fundamentals and technical analysis.Monday, August 28, 2006

Why We Think Several Companies will Bid on Metalline Mining’s Zinc Project

State of the Zinc Market

As we mentioned 3 months ago, there’s a worldwide zinc crisis. As you can see from the zinc production and consumption statistics for the first half of 2006 from the ILZSG (International Lead and Zinc Study Group), zinc consumption is far outpacing zinc production, led by strong and consistent growth in demand in Asia. China’s zinc demand is forecasted to increase by 56% by 2010 , exasperating the current supply crisis. This article from early this year does a good job outlining the case for zinc and zinc stocks.

The below charts of zinc consumption by continent and LME zinc inventories over the last few years help illustrate this current situation:

Zinc consumption has continued to grow so much despite the meteoric rise in the price of zinc, with most of that growth coming from Asia. The average price of zinc for the first half of 06 was more than double the price for the first half of 05, yet Asian consumption still grew 5% during that period. With China building the equivalent of a city the size of Philadelphia every month, with its standard of living still nowhere near that of the West, and with the enormous savings they have, it's hard to imagine Asian consumption slowing for more than a blip on their long-term growth path.

Worldwide consumption exceeded worldwide mine production by 5.44% in H1 06. Asian consumption exceeded Asian mine production by 42.23%, as China become a net importer of zinc in 2004. This excess of consumption over production is reflected in the precipitous decline in LME zinc inventories since 2004. At the current rate of decline, the LME will be out of zinc within months, escalating the severity of the crisis.

Largest Zinc Projects in the World

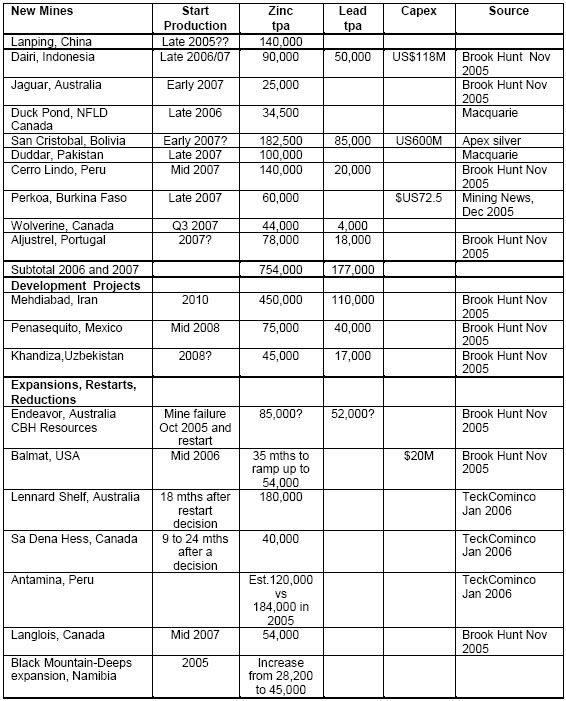

Metalline Mining's (MMGG's) Sierra Mojada could be the second biggest new zinc project in the world for years to come. Sierra Mojada's similar in size to Apex Silver's San Cristobal in Bolivia on this list of big zinc projects:

The biggest zinc project (by far) is Mehdiabad in Iran. They're currently trying to get financing now for their $1.6 billion in capital expenditures, during this time of political crisis there. If that huge project fails to get to production, that's 6% of the expected world supply of zinc that won't be coming, which would be extremely bullish for zinc and MMGG. Given the enormous Asian demand and the quickly declining zinc inventories, it’s hard to imagine a zinc supply surplus over demand in coming years even if there’s a severe worldwide slowdown.

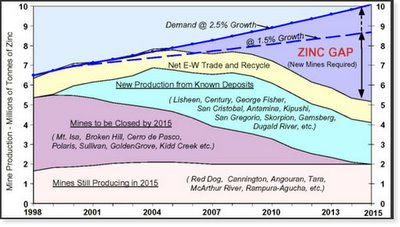

With many zinc mines scheduled to cease production in coming years, zinc miners with multi-billion dollar deposits in safe areas of the world coming into production during that time should do extremely well, as they help fill the zinc supply gap:

What Makes Metalline Mining’s Sierra Mojada Zinc Project Unique

Anglo American plc’s Skorpion mine in Namibia, Africa, is the lowest-cost zinc producer in the world, producing zinc at a cost of about 25 cents/pound. The Skorpion mine is the first and only mine in the world using the solvent extraction electrowinning process for extracting Super High Grade zinc (SHG zinc is 99.995% zinc) from oxide zinc ore. Green Team International (GTI) completed the feasibility study for Skorpion and then designed, supervised the construction and operated the mine and extraction plant through initial production and until they were at 90% of capacity, at which point they turned over operations to Anglo American.

Metalline Mining has hired GTI to do the feasibility study at Sierra Mojada in Mexico, as their experience with the unique process should make going to production almost a “turnkey” process. Using a proven team to implement a proven process that yields the lowest-cost zinc in the world, in one of the largest zinc projects in the world, in a safe area of the world, makes Sierra Mojada a one-of-a-kind project that’s extremely attractive to larger mining companies.

The Potential Bidders

In January, we explained why we think Anglo American, the second largest mining company in the world, will try to buy MMGG's zinc deposit. As the Mining industry continues to consolidate, we believe several other bidders for Metalline’s Sierra Mojada zinc project will emerge after completion of the feasibility study next year.

Other mining majors are likely to bid as their coffers fill up with incredible sums of cash while their reserves and resources decline. Rather than investing heavily in exploration, decreasing reported profits and making them look less attractive to the financial community, large mining companies are buying other companies with large mineral deposits.

Xstrata, which will become the 5th-biggest mining company in the world after completion of their recent acquisition of Falconbridge, is not done with their acquisition spree. After they beat out Inco and Phelps Dodge in the bidding war for Falconbridge, CEO Mick Davis said, “We are always thinking about the next deal.”

Teck Cominco, the world’s largest zinc miner, just lost out in the bidding war for Inco last week, withdrawing their C$17.8 billion bid. CEO Don Linsay said Teck “will now pursue other acquisitions.”

Australian miner Ziniflex, the world’s second largest zinc producer, just announced a more than 4-fold increase in annual profit and a willingness to participate in acquisition opportunities in the global zinc market. CEO Greig Gailey said, “We still think there are opportunities in consolidation, and we would be willing to participate.”

EuroZinc Mining and Lundin Mining, two mid-cap zinc producers, recently announced a merger. The new company, to be called Lundin Mining, will have an interest in 4 of the top 15 zinc mines in the world, and will be looking for more huge zinc deposits. Colin K. Benner, Vice-Chairman and Chief Executive Officer of EuroZinc, stated: "The combined financial strength and collective expertise of our talented personnel will allow the new company to pursue global growth opportunities." Karl-Axel Waplan, President and Chief Executive Officer of Lundin Mining, added: "The combined strengths of Lundin Mining and EuroZinc will allow an acceleration of both companies' aggressive growth strategies… we intend to both maximize our existing assets and also continue to pursue other world-class opportunities..." On the merger conference call, the CEO’s stated that they would be looking to acquire “world-class pre-production base metals deposits wherever they are in the world.”

The bigger zinc producers are on the lookout for world class zinc deposits to extend their cash flow beyond the reserve life of their existing production. With MMGG’s Sierra Mojada likely to be one of the 3 largest zinc projects in the world coming to production in the next few years, and the other 2 largest being in politically risky Iran and Bolivia (and already owned by bigger mining companies), we’d be very surprised if MMGG doesn’t get multiple bidders when they complete the feasibility study next year.

Junior Mining Sector Bloodbath Creates Opportunity

Like other junior mining stocks, MMGG has dropped over 50% from its May high. However, as a recent article pointed out, the sector is prepared to rebound, as it historically does in fall following a summer slowdown.

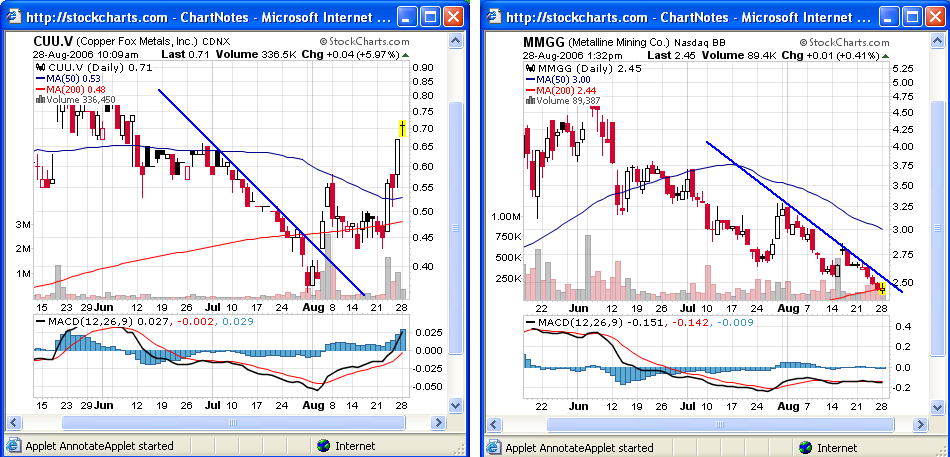

Despite a recent technical buy signal, MMGG has pulled back to retest the support area in the mid-2’s. A big seller has been pressuring the stock, keeping a lid on it in the relatively low volume trading environment, just like a few weeks ago when a big seller was pressuring Copper Fox (CUU). We mentioned the significant seller of CUU when we first highlighted Copper Fox in early August. Now that its big seller’s gone, CUU has doubled in less than a month. Notice how similar CUU’s chart through the end of July looks to MMGG’s current chart:

Once the big seller who’s been holding MMGG back on low volume is gone, we expect the stock to rebound in a similar manner to how Copper Fox has rebounded. When it breaks the downtrend from May, it will establish a new uptrend and should also trigger a positive divergence MACD buy signal, with a higher low on MACD at a lower low in price.

Any way you look at it, MMGG's valuation is ridiculous at about 1% of the value of the metal in the ground. The late Julian Baring used a rule of thumb for valuing metal shares:

"Buy up to 10% of the in situ value of a deposit using current metal prices, hold up to 40% and sell above 40% taking no prisoners!!!!"

If Metalline Mining can prove up their silver and other zinc deposits, they'll be worth even more.

At the end of last month, in our last update on MMGG, we listed 6 events in coming months that should help the stock move higher. Each of those 6 events are a few weeks closer to fruition, and should start moving the stock up toward a more appropriate valuation.

Conclusion

Once the feasibility study on the Sierra Mojada zinc deposit is done, we think the takeover bidders will come out of the woodwork. However, barring a frenzied bidding war, the best path for shareholders would probably be to move into production alone.

Given the zinc crisis situation that will likely get much worse in coming years due to Asia’s insatiable demand and a lack of new projects to fill the supply gap, we believe that Metalline Mining, with the biggest zinc project in the world that’s in a secure area, will be in the driver’s seat at the right place at the right time.

Wednesday, August 23, 2006

Copper Fox Metals Breakout

While it could always retest the breakout area, we believe Copper Fox has changed course and will establish a new uptrend toward its fair value at much higher levels. Copper Fox remains a great buy for the long term.

Wednesday, August 16, 2006

JER Envirotech Malaysia Production Facility in Operation

"With our Malaysian operation producing, we are the first company to commercially produce 4 feet by 8 feet wood plastic composite panel boards," stated Mr. Ernie Calica, general manager and vice-president of Asian Operations of JER.

From their Corporate Communications newsletter, we can see some detailed production plans:

1. Delta, B.C.: line#1. 2005 began production. Capability to produce up to 1,400 lbs per hour of WPC (wood plastic compound). Running at 33% capacity. Management expects to ramp up to two shifts (67% capacity) in the fourth quarter.

2. Delta: #2 compound line was ordered in March and is expected, at full capacity, to have 60% greater throughput than the existing line, with the ability to generate monthly revenues of US$500,000. It is expected to begin trial testing this month.

3. The Delta panel board facility is expected to begin trial production this month. At capacity it is expected to produce revenues of $500,000 per line, per month.

4. The Philippine Joint Venture panel board plant has been delayed and the trial production is expected to begin by the end of this calendar year.

5. India: JER and Master Trust Ltd expect to order equipment for its first panel board line in October, with installation and trial testing to be completed by March 2007 and initial production beginning in May 2007.

JER was trading just over $1.00 when we first mentioned it in April. After a summer dip, it’s back near the $1.00 level again. While there have been some production delays, the company still expects to grow sales to over $2 million per month next year. We continue to believe that investors from the $1.00 area and below (market cap below $30 million) will be handsomely rewarded over the long term as the company continues to grow.

Friday, August 04, 2006

Copper Fox Metals for the Long Term

Figures 5 and 6 on page 6 of the shareholder letter, showing the potential project economics, indicate how undervalued the project is even when using the extremely low prices of $1.00/lb copper (currently near $3.50/lb.), $375/oz gold (currently near $650/oz), $5.50 silver (currently over $12/oz), and $6/lb molybdenum (currently near $25/lb). These figures, while not official until completion of a feasibility study, suggest a very good likelihood that the project will prove feasible.

The biggest issue for the Schaft Creek project has been that, because of their remote location, the infrastructure isn't completely there yet (which is one reason why it has traded at such a tiny market cap vs. the huge opportunity). They’ve been planning to use a new road being put in by NovaGold, as well as the power plant NovaGold’s planning, so they’re somewhat dependent on NovaGold’s success. Barrick Gold’s unsolicited $1.5 billion takeover bid for NovaGold last week, as well as today’s announced NovaGold acquisition of Coast Mountain Power, help ensure the infrastructure Schaft Creek needs will be in place. Copper Fox and Schaft Creek seem more likely to achieve success than ever.

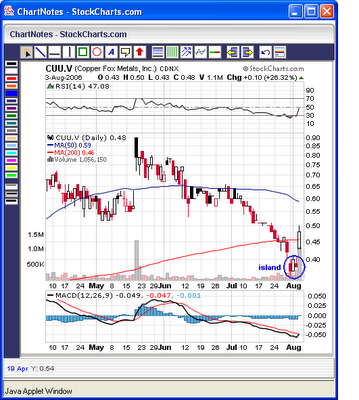

Despite the extremely favorable and improving risk/reward ratio for Copper Fox and the Schaft Creek project, the stock has been caught up in the junior miners selloff the past few months. Despite trading as high as .90 on May 18, CUU (in Canada) traded under .40 earlier this week, as a significant seller liquidated their position. Apparently, that seller finished pressuring the stock yesterday, as it gapped up and rallied strongly today, closing at .48. The activity this week has created a bullish island reversal pattern, a powerful bottoming indicator created when a stock gaps down, trades for a few days, and then gaps back up, leaving behind an island separated from the rest of the chart:

Along with the bullish island reversal, which usually marks the beginning of a sharp reversal up, MACD is turning up from a low level and about to cross over its trigger line to create a buy signal. Today’s big volume of over a million shares on a strong up day is also very bullish.

Considering that Copper Fox recently completed a private placement of CUU shares at .55 and .60 (Canadian), we believe that investors taking advantage of this buying opportunity under .60 will reap huge rewards over the long term. While we don’t like the fundamentals for copper as much as we do for zinc, Copper Fox should be successful even if the price of Copper drops significantly, and the gold, molybdenum, and silver value in Copper Fox help to diversify the risk of a drop in any one metal’s price.

Copper Fox's web site has a host of great articles and information on the project, with buy recommendations from several analysts, including Lawrence Roulston, John Kaiser, and Brien Lundin's Gold Newsletter. The PowerPoint presentation there is also very informative. Pages 18-19 show the proximity of Schaft Creek to NovaGold’s Galore Creek.

Once Copper Fox proves the economic viability of the Schaft Creek project with the feasibility study, Teck Cominco will have the option to buy out 75% of the property, and may choose to buy out Copper Fox completely (there also have been rumors that NovaGold would buy out Copper Fox). However, that result would be a big windfall to current shareholders. Whether or not Teck exercises that option, Copper Fox looks like a great buy for the long term, with potential for a mine of world-class size.

Archives

December 2005 January 2006 February 2006 March 2006 April 2006 May 2006 July 2006 August 2006 October 2006 November 2006 December 2006 January 2007 February 2007 March 2007 April 2007 May 2007 June 2007 August 2007 October 2007 November 2007 May 2008 September 2008 October 2008 January 2009 February 2009 March 2009 April 2009 May 2009 June 2009 July 2009 August 2009 September 2009 October 2009 November 2009 December 2009 March 2010 May 2010 June 2010

Great Trades Home Email GreatTrades

Great Investments Blog Great Investment Articles BlogDisclaimer: Great Trades may have a position in all or some of the stocks discussed in this blog, but is not paid by any company to promote their stock. Great Trades contains opinions, none of which constitute a recommendation that any particular security, transaction, or investment strategy is suitable for any specific person. Great Trades does not provide personalized investment advice.