Great Trades

Great stock trades based on fundamentals and technical analysis.Thursday, January 26, 2006

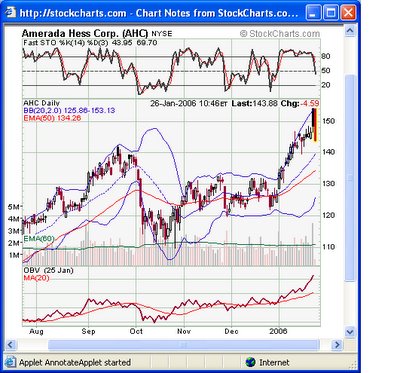

Amerada Hess (AHC) Buy Opportunity

Amerada Hess (AHC), a leading oil producer, absolutely demolished analyst estimates by reporting $4.31 EPS yesterday vs. analyst estimates of $3.26 EPS. It's not often you see a companyblow out earnings by over a dollar. It was bid up over $10 in premarket yesterday, as the fundamental picture looked phenomenal with near 100% earnings growth at a forward PE of 8. However, oil futures took a hit during the day when an oil inventories report showed higher levels of inventory than expected. Oil stocks sold off hard on the news, and AHC closed up less than $2.

Today, the oil stock selloff is continuing, with early oil futures weakness. AHC traded down to the 143's, about $3 below where it was before the blowout earnings.

Given the incredible fundamentals after the earnings blowout, we feel that AHC is a good buy on this oil stock selloff for at least a quick trade. However, a close stop should be used in case oil and oil stocks sell off hard again. Given the discount from the pre-earnings price and the amazing earnings of AHC, we think AHC will move higher as long as the oil sector as a whole stays strong. With oil prices where they are, AHC and other oil producers have been rolling in profits. Longer term, we believe they'll continue to do very well as the demand from countries like China and India increases the global energy needs significantly.

Archives

December 2005 January 2006 February 2006 March 2006 April 2006 May 2006 July 2006 August 2006 October 2006 November 2006 December 2006 January 2007 February 2007 March 2007 April 2007 May 2007 June 2007 August 2007 October 2007 November 2007 May 2008 September 2008 October 2008 January 2009 February 2009 March 2009 April 2009 May 2009 June 2009 July 2009 August 2009 September 2009 October 2009 November 2009 December 2009 March 2010 May 2010 June 2010

Great Trades Home Email GreatTrades

Great Investments Blog Great Investment Articles BlogDisclaimer: Great Trades may have a position in all or some of the stocks discussed in this blog, but is not paid by any company to promote their stock. Great Trades contains opinions, none of which constitute a recommendation that any particular security, transaction, or investment strategy is suitable for any specific person. Great Trades does not provide personalized investment advice.