Great Trades

Great stock trades based on fundamentals and technical analysis.Thursday, January 26, 2006

Incyte Corporation (INCY) for the long term

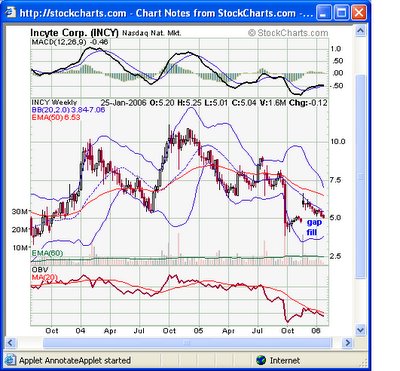

On September 27, 2005, INCY gapped down from the 7's to the 4's on news the FDA delayed movement into phase III trials for the company's drug for the treatment of HIV. The FDA requested that the company conduct another phase II trial before moving on to phase III. While this news was a setback, once the market sees clarity on the HIV trials going forward, the stock should rebound.

On November 21, 2005, INCY gapped up from below 5 to trade as high as 6.65 on news of a deal with Pfizer for their CCR2 antagonist program that could be worth up to $803 million.

"With a partnership on CCR2 inhibitors in place, we expect Incyte to receive more visibility on other clinical programs," says Jefferies & Co. analyst Eun Yang. "This deal on CCR2 inhibitors validates Incyte's discovery and development program, and provides cash up front and milestones. The potential for the deal is $800 million, and I think what has been priced in today is just the $40 million upfront payment and the $20 million in notes — the things that are definite. I don't think the full $800 million has been priced in at all. I think there is still a lot of upside potential in the stock based on what Pfizer is doing." (Yang doesn't own shares of Incyte; Jefferies & Co. doesn't have an investment-banking relationship with the company.)

Since that news, the stock has faded back to the 5 area, below where it traded in the weeks before the Pfizer news. Filling this gap creates a more solid base for future upside movement. After this selloff, any good upside movement will trigger some technical buy signals.

Multiple Incyte insiders, including the CEO, have purchased INCY at higher prices, many at over $7/share. Management has an outstanding history of success with big pharmaceutical companies. CEO Dr. Paul A. Friedman has an excellent track record of developing HIV drugs. When he joined DuPont in 1994 the company was valued at $800 million. The company was sold to Bristol Myers at a valuation of $7.8 billion in 2001. Dr. Friedman also attracted the vast majority of his team to come and work with him at Incyte, with 120 scientists from DuPont now working at the company.

With a lucrative partnership with Pfizer for a portion of its drug portfolio and a strong pipeline of drug candidates, INCY should get plenty of news flow this year to drive the stock price higher. We like INCY in the 5 area for a long-term hold.

Archives

December 2005 January 2006 February 2006 March 2006 April 2006 May 2006 July 2006 August 2006 October 2006 November 2006 December 2006 January 2007 February 2007 March 2007 April 2007 May 2007 June 2007 August 2007 October 2007 November 2007 May 2008 September 2008 October 2008 January 2009 February 2009 March 2009 April 2009 May 2009 June 2009 July 2009 August 2009 September 2009 October 2009 November 2009 December 2009 March 2010 May 2010 June 2010

Great Trades Home Email GreatTrades

Great Investments Blog Great Investment Articles BlogDisclaimer: Great Trades may have a position in all or some of the stocks discussed in this blog, but is not paid by any company to promote their stock. Great Trades contains opinions, none of which constitute a recommendation that any particular security, transaction, or investment strategy is suitable for any specific person. Great Trades does not provide personalized investment advice.