Great Trades

Great stock trades based on fundamentals and technical analysis.Tuesday, January 03, 2006

Metalline Mining (MMGG) for the long term

From the Metalline Mining Web site (http://www.metalin.com/zinc_solvent.html) :

“Zinc is one of the most useful and essential metals. Zinc's primary use is corrosion protection in the galvanized steel industry. The recycle life of galvanized steel can be up to 100 years and the added cost is justified by decreased maintenance cost over ungalvanized steel.

The largest use of galvanized steel is in the automobile industry and in commercial and residential construction. Construction is zinc's fastest growing sector where it is used, for Structural support, as galvanized electric power, microwave, cellular and other towers, steel beams, floor joists, studs and trusses and it is used in ductwork, roofing and decorative interior and exterior covering.

Die cast zinc parts are used in automobiles, appliances, tools and computers.

Zinc alloys with copper, tin, lead, aluminum and magnesium are used in the construction, automotive, electrical and consumer products industries. Other zinc uses are in batteries, tires, rubber goods, paint pigments, ceramic glazes, cosmetics, pharmaceuticals and chemicals.

Zinc is an essential nutrient for all life, plant and animal and is used in the food industries, nutritional supplements, animal feed and fertilizers.

Zinc consumption has grown dramatically over the past 30 years and continues to increase and new uses for zinc are being developed. Zinc fuel cells are under development for generating electricity and could create significant new demand.”

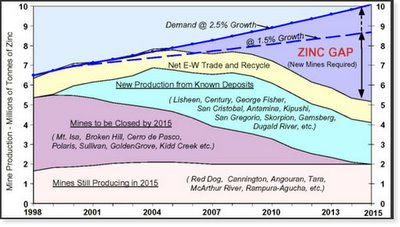

Zinc Supply Gap

Following several decades of ample zinc supply, a major supply gap is developing in the zinc markets that will likely have a profound impact on future zinc exploration and mine development (from http://www.yukonzinc.com/zincMarkets.htm):

China has been a main driver behind the supply gap, as they’ve gone from a major exporter of refined zinc to a major net importer in 2005.

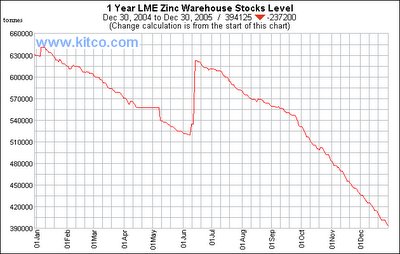

As you can see from the below chart, the London Mercantile Exchange Zinc Warehouse Stocks Level decreased by over 37.5% in 2005, indicating the zinc shortage is getting worse quickly (live zinc charts at http://www.kitcometals.com/charts/ZINC_historical.html):

As the zinc supply shortfall worsens and inventories continue to decline, the price of zinc increases. You can see from the below chart that the price of zinc has more than doubled in the last 18 months:

Unlike other commodities, there are few giant zinc deposits in inventory to fill the gap due to depletion of reserves during the past several years of low zinc prices. While old reserves get depleted, no new large zinc mines are set to come into production in the next two years.

Metalline Mining Zinc

The Skorpion mine in Namibia, Africa, is the 8th largest zinc mine in the world. In 2003, the Skorpion mine became the first mine to use the Solvent Extraction Electro-Winning (SXEW) to produce refined zinc from oxide zinc. The cost of producing refined zinc by SXEW is $0.25 per pound, a 30% advantage over the rest of the zinc industry, which produces zinc from a sulfide concentrate through the smelter process at a cost of $0.35 per pound. This new technological advance has made Skorpion the world low cost zinc producer.

Using the same SXEW process as the Skorpion mine, Metalline Mining’s Sierra Mojada mine in Mexico could be one of the world’s 10 largest zinc mines and one of the lowest cost producers (and possibly the lowest cost producer). With a similar cost to Skorpion’s $0.25 per pound, Metalline would have a margin of over $0.60 per pound at the current zinc price of over $0.85 per pound ($0.85-$0.25=$0.60). With the price of zinc likely headed much higher given the aforementioned supply gap situation, the profit potential for Metalline’s zinc reserve is enormous.

Feasibility Study

After discovering mineralization and doing extensive drilling to show the presence of enough marketable metals to move forward, mining companies go through a feasibility study, a process to define the metals reserve (metallurgy), define the costs and profitability, get regulatory approvals, and design the mine (and refinery/extraction plant in cases where that step is included). The feasibility study provides the extensive proof that the mine will make money, and is used for financing to go into production. Typically, this financing comes from a takeover by a major mining company, a joint venture with such a company, or a combination of bank debt financing and equity financing.

Metalline Mining began the feasibility study process about a year ago, proving they had over $4 billion of Zinc earlier this year in the metallurgy portion. The feasibility study has stalled in recent months because of a lack of funding, which Metalline is addressing with the current private placement. Once the financing is complete (likely in the next couple of weeks), the feasibility study should be complete within 9 months to a year. The cost of building a mine and extraction plant is likely to be in the $250 million to $400 million range.

To conduct the feasibility study, Metalline selected Green Team International (GTI), the same company that conducted the feasibility study on the Skorpion mine. GTI designed, supervised the construction, and operated the Skorpion mine and extraction plant through initial production and until the mine and plant were at 90% capacity. Given Metalline's plan to use the same efficient, cost-saving process as Skorpion, GTI was the perfect choice.

Once the company raises the money required to complete the feasibility study, most of the risk for MMGG will be gone. The remaining part of the feasibility study is mostly defining the costs and profitability. Once that’s complete, virtually all the risk will be gone, and MMGG will likely have several takeover bids to fall back on as the worst-case scenario, with the most lucrative path to move to production with debt and equity financing (at a much higher stock price). Skorpion was bought out by Anglo American (AAUK) at the completion of their feasibility study, resulting in a huge profit for Reunion Mining shareholders even though the price of zinc was near a bottom, much lower than current prices. Anglo American is one likely bidder for MMGG at the completion of the feasibility study.

Valuation Based on Zinc Alone

With nearly 5 billion pounds of zinc, a $0.60 per pound margin would mean nearly $3 billion of gross profits for Metalline Mining. Even if the initial costs are in the $400 million range for the mine and extraction plant and you discount heavily for the approx. 3-year wait to get into production and the profits coming over 10-12 years, MMGG is still extremely undervalued at its current market cap under $30 million. Earnings per year once in production should be several times the current market cap. Metalline's zinc reserve alone is worth over 100 times its current market cap.

Company insiders, recognizing the long-term value, have bought MMGG shares between $1 and $1.66 over the last few years, and none of the current management has sold.

Any way you look at it, MMGG is severely undervalued based on the zinc opportunity.

Private Placements Depress Share Price

Metalline Mining initiated a private placement at $1/share over 2 years ago to raise capital for the reserve definition and feasibility study. Many of those private placement investors sold their shares as the lockup expired beginning in late 2004, pressuring the stock price over the last 15 months. Despite the fundamentals improving dramatically since then, with the price of zinc nearly doubling along with the successful completion of the metallurgy portion of the feasibility study, the stock price has lost most of its value from over $3 in October 2004 because of this selling.

Early in 2005, Metalline Mining attempted to finance the rest of the feasibility study with a private placement at $1.50 per share. However, the aforementioned profit-taking investors and big investors who wanted to get private placement shares cheaper sold, pressuring the stock down to $1.50 after starting the year at $2. Metalline was forced to lower the private placement price to $1.125, after which the stock again sold down to the private placement price. Big investors insisted on a still lower price for the private placement, so the placement price was lowered to .80, with a $1.25 warrant. Yet again, the stock sold down to the new private placement price, as investors sold their old shares to get the new shares and the warrant. Now that the private placement is coming to a close, this selling pressure along with tax-loss selling has decreased. This private placement should get them through the rest of the feasibility study.

Rally Last Week on Big Volume – Buy Signals

With zinc hitting a 16-year high, other zinc exploration stocks like Canadian Zinc and Yukon Zinc have run up over 75% in recent weeks on big volume. MMGG had been lagging because of the aforementioned reasons, but finally began to join the zinc stock rally last week. MMGG rallied 22.5% last week from a 6-year low on the highest volume since it hit $3.28 on October 1, 2004, even though it was a holiday-shortened week and some investors must have been tax-loss selling into the rally.

Last week’s rally triggered some technical buy signals on the MMGG weekly chart:

With the volume increase and accompanying price increase, an On Balance Volume (OBV) buy signal was triggered last week. You can find out more about OBV here: http://stockcharts.com/education/IndicatorAnalysis/indic-obv.htm.

After months of bullish divergence between MACD and the stock price, with the MACD increasing from its summer low while the price continued lower, MMGG also finally broke out of its 15-month downtrend channel last week. This break from the channel triggered a Parabolic SAR buy signal. You can find out more about Parabolic SAR here: http://stockcharts.com/education/IndicatorAnalysis/indic_ParaSAR.htm.

These technical analysis buy signals indicate that MMGG has seen its bottom and is likely to continue higher in coming weeks and months.

Metalline Mining Silver/Copper

In addition to the zinc reserve currently in the feasibility stage, Metalline Mining also has high-grade silver and copper mineralization on the North side of its Sierra Mojada property. Metalline’s Sierra Mojada property has very unusual geology (http://www.metalin.com/geology.html), with 2 distinct mineral systems: high zinc mineralization on the South side of the Sierra Mojada fault and high silver and copper mineralization on the North side. Over 5000 samples had been collected from the North side through 1999, indicating very high grade silver and copper mineralization. In 1999, with the positive feasibility study from Skorpion, Metalline shifted its focus to the enormous potential of its zinc mineralization, putting the silver/copper exploration on hold.

With GTI hired to do the feasibility study, Metalline staff has been able to again give the silver/copper mineralization some attention. Over 2000 new samples have been collected, the results of which should be available shortly. If the results continue to be good, the silver/copper side of MMGG could have as much or more potential than the zinc side. Up to this point, Metalline had not actively promoted the silver/copper side of their property.

Future Plans

Metalline management recognizes that there are two areas that need improvement. First, as a bulletin board stock, they’ve had difficulties attracting big investors, many of whom won’t invest in bulletin board stocks. Look for them to pursue a Toronto or Amex listing, which would give them more credibility and open up doors to a high number of large investors. Secondly, look for them to significantly increase the marketing and PR efforts, possibly hiring a PR firm or two to help them in that area. The lack of news and promotion combined with the private placement sellers hurt the stock last year.

Conclusion

Given the extremely low valuation versus the enormous zinc opportunity, MMGG, trading at less than 1% of the proven value of their zinc reserve, should be several times higher after they complete the feasibility study. If the results from their recent silver/copper sampling continue to be positive, that will also help the stock move significantly higher. At the current level under $1, MMGG looks like a steal, and anything under $2 also looks like a great value with huge upside for the long term.

i fully agree that the artificial pressures on the stock have created a rare buying opportunity. resource investor should definitely have this one in their portfolio. while it will take time for things to come to fruition, note that the period leading up to publication of a feasibility study is usually a great period to own the respective company's stock - it often produces the first major upleg.

"Company insiders, recognizing the long-term value, have bought MMGG shares between $1 and $1.66 over the last few years, and none of the current management has sold."

however indiders transactions acording Yahoo Finance does not agrree with it

http://finance.yahoo.com/q/it?s=MMGG.OB

The purchase transactions, with no sales, are the company management.

1. Other than a desire to use SKEW and the same contract operators as Skorpion (GTI) on their Mexican zinc property, what does a AAUK owned mine in Namibia have to do with Metalline? The Metalline web site is misleading as it prominently features Skorpion as if it owns it.

2. You mentioned MMGG proved "...they had over $4 billion of Zinc earlier this year in the metallurgy portion". Are these resources, reserves? How many ounces are involved? Do they plan to publish a NI 43-101 compliant resource estimate?

Thanks for any response.

2. Per this press release: http://www.metalin.com/word/05_18_05_update.doc, MMGG has defined the resource, but the SEC won't let them call it a reserve until the feasibility study is done. Using a 5% cutoff grade (using only grades over 5%), the results indicated "2.23 million metric tons contained zinc metal."

A metric ton is 2,204.6 pounds, so 2.23 million metric tons is 4,916,258,000 pounds, or 78,660,000,000 ounces. That's nearly 5 billion pounds of zinc, so with zinc around $1/pound now, that's nearly $5 billion worth of zinc, and that's only counting the zinc at a conservative 5% grade or higher -- there's much more than that when using a lower cutoff, which they would do now with the higher price of zinc.

NI 43-101 is a Canadian rule authored by the Canadian Securities Administrators (CSA). As a U.S. company with property in Mexico, they have not done any work towards NI 43-101 compliance, but would do so as part of an application to get listed in Toronto.

[url=http://xwn.in/blackjack_samsung-blackjack-ii-walpaper]casino nsw[/url] predict winning lottery numbers [url=http://xwn.in/betting_betting-game]betting game[/url]

casinos in va http://xwn.in/blackjack_voicemail-on-blackjack-phone

[url=http://xwn.in/casino-playing-cards_piatnick-playing-cards]casinos in mississippi[/url] mirage casino phone number [url=http://xwn.in/slot_expansion-slot-on-blackberrry-7780]expansion slot on blackberrry 7780[/url]

gambling affiliates forums http://xwn.in/blackjack_blackjack-buffer-saiga osage million dollor casino [url=http://xwn.in/slot_play-free-online-casino-slot-games]play free online casino slot games[/url]

http://topcitystyle.com/28-men-size18.html shoes for heel spur [url=http://topcitystyle.com/?action=products&product_id=2074]italian mens fashion designers[/url]

<< Home

Archives

December 2005 January 2006 February 2006 March 2006 April 2006 May 2006 July 2006 August 2006 October 2006 November 2006 December 2006 January 2007 February 2007 March 2007 April 2007 May 2007 June 2007 August 2007 October 2007 November 2007 May 2008 September 2008 October 2008 January 2009 February 2009 March 2009 April 2009 May 2009 June 2009 July 2009 August 2009 September 2009 October 2009 November 2009 December 2009 March 2010 May 2010 June 2010

Great Trades Home Email GreatTrades

Great Investments Blog Great Investment Articles BlogDisclaimer: Great Trades may have a position in all or some of the stocks discussed in this blog, but is not paid by any company to promote their stock. Great Trades contains opinions, none of which constitute a recommendation that any particular security, transaction, or investment strategy is suitable for any specific person. Great Trades does not provide personalized investment advice.