Great Trades

Great stock trades based on fundamentals and technical analysis.Friday, August 04, 2006

Copper Fox Metals for the Long Term

Figures 5 and 6 on page 6 of the shareholder letter, showing the potential project economics, indicate how undervalued the project is even when using the extremely low prices of $1.00/lb copper (currently near $3.50/lb.), $375/oz gold (currently near $650/oz), $5.50 silver (currently over $12/oz), and $6/lb molybdenum (currently near $25/lb). These figures, while not official until completion of a feasibility study, suggest a very good likelihood that the project will prove feasible.

The biggest issue for the Schaft Creek project has been that, because of their remote location, the infrastructure isn't completely there yet (which is one reason why it has traded at such a tiny market cap vs. the huge opportunity). They’ve been planning to use a new road being put in by NovaGold, as well as the power plant NovaGold’s planning, so they’re somewhat dependent on NovaGold’s success. Barrick Gold’s unsolicited $1.5 billion takeover bid for NovaGold last week, as well as today’s announced NovaGold acquisition of Coast Mountain Power, help ensure the infrastructure Schaft Creek needs will be in place. Copper Fox and Schaft Creek seem more likely to achieve success than ever.

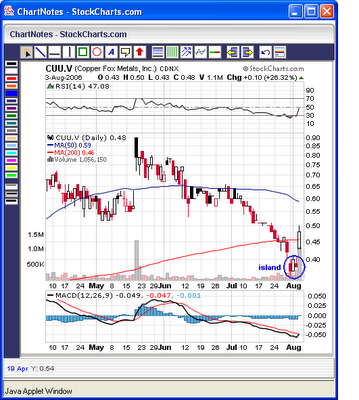

Despite the extremely favorable and improving risk/reward ratio for Copper Fox and the Schaft Creek project, the stock has been caught up in the junior miners selloff the past few months. Despite trading as high as .90 on May 18, CUU (in Canada) traded under .40 earlier this week, as a significant seller liquidated their position. Apparently, that seller finished pressuring the stock yesterday, as it gapped up and rallied strongly today, closing at .48. The activity this week has created a bullish island reversal pattern, a powerful bottoming indicator created when a stock gaps down, trades for a few days, and then gaps back up, leaving behind an island separated from the rest of the chart:

Along with the bullish island reversal, which usually marks the beginning of a sharp reversal up, MACD is turning up from a low level and about to cross over its trigger line to create a buy signal. Today’s big volume of over a million shares on a strong up day is also very bullish.

Considering that Copper Fox recently completed a private placement of CUU shares at .55 and .60 (Canadian), we believe that investors taking advantage of this buying opportunity under .60 will reap huge rewards over the long term. While we don’t like the fundamentals for copper as much as we do for zinc, Copper Fox should be successful even if the price of Copper drops significantly, and the gold, molybdenum, and silver value in Copper Fox help to diversify the risk of a drop in any one metal’s price.

Copper Fox's web site has a host of great articles and information on the project, with buy recommendations from several analysts, including Lawrence Roulston, John Kaiser, and Brien Lundin's Gold Newsletter. The PowerPoint presentation there is also very informative. Pages 18-19 show the proximity of Schaft Creek to NovaGold’s Galore Creek.

Once Copper Fox proves the economic viability of the Schaft Creek project with the feasibility study, Teck Cominco will have the option to buy out 75% of the property, and may choose to buy out Copper Fox completely (there also have been rumors that NovaGold would buy out Copper Fox). However, that result would be a big windfall to current shareholders. Whether or not Teck exercises that option, Copper Fox looks like a great buy for the long term, with potential for a mine of world-class size.

Archives

December 2005 January 2006 February 2006 March 2006 April 2006 May 2006 July 2006 August 2006 October 2006 November 2006 December 2006 January 2007 February 2007 March 2007 April 2007 May 2007 June 2007 August 2007 October 2007 November 2007 May 2008 September 2008 October 2008 January 2009 February 2009 March 2009 April 2009 May 2009 June 2009 July 2009 August 2009 September 2009 October 2009 November 2009 December 2009 March 2010 May 2010 June 2010

Great Trades Home Email GreatTrades

Great Investments Blog Great Investment Articles BlogDisclaimer: Great Trades may have a position in all or some of the stocks discussed in this blog, but is not paid by any company to promote their stock. Great Trades contains opinions, none of which constitute a recommendation that any particular security, transaction, or investment strategy is suitable for any specific person. Great Trades does not provide personalized investment advice.