Great Trades

Great stock trades based on fundamentals and technical analysis.Monday, January 30, 2006

Removing AHC and BTU from Coverage

Thursday, January 26, 2006

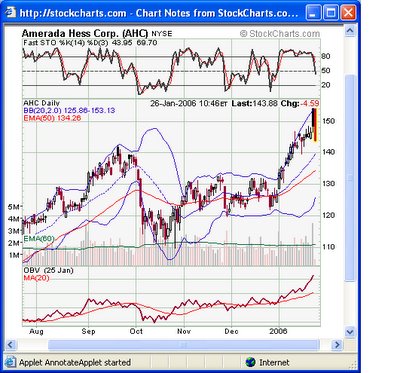

Amerada Hess (AHC) Buy Opportunity

Amerada Hess (AHC), a leading oil producer, absolutely demolished analyst estimates by reporting $4.31 EPS yesterday vs. analyst estimates of $3.26 EPS. It's not often you see a companyblow out earnings by over a dollar. It was bid up over $10 in premarket yesterday, as the fundamental picture looked phenomenal with near 100% earnings growth at a forward PE of 8. However, oil futures took a hit during the day when an oil inventories report showed higher levels of inventory than expected. Oil stocks sold off hard on the news, and AHC closed up less than $2.

Today, the oil stock selloff is continuing, with early oil futures weakness. AHC traded down to the 143's, about $3 below where it was before the blowout earnings.

Given the incredible fundamentals after the earnings blowout, we feel that AHC is a good buy on this oil stock selloff for at least a quick trade. However, a close stop should be used in case oil and oil stocks sell off hard again. Given the discount from the pre-earnings price and the amazing earnings of AHC, we think AHC will move higher as long as the oil sector as a whole stays strong. With oil prices where they are, AHC and other oil producers have been rolling in profits. Longer term, we believe they'll continue to do very well as the demand from countries like China and India increases the global energy needs significantly.

Incyte Corporation (INCY) for the long term

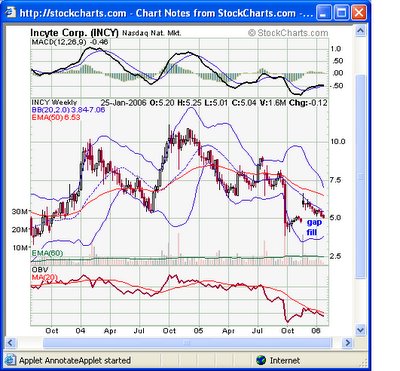

On September 27, 2005, INCY gapped down from the 7's to the 4's on news the FDA delayed movement into phase III trials for the company's drug for the treatment of HIV. The FDA requested that the company conduct another phase II trial before moving on to phase III. While this news was a setback, once the market sees clarity on the HIV trials going forward, the stock should rebound.

On November 21, 2005, INCY gapped up from below 5 to trade as high as 6.65 on news of a deal with Pfizer for their CCR2 antagonist program that could be worth up to $803 million.

"With a partnership on CCR2 inhibitors in place, we expect Incyte to receive more visibility on other clinical programs," says Jefferies & Co. analyst Eun Yang. "This deal on CCR2 inhibitors validates Incyte's discovery and development program, and provides cash up front and milestones. The potential for the deal is $800 million, and I think what has been priced in today is just the $40 million upfront payment and the $20 million in notes — the things that are definite. I don't think the full $800 million has been priced in at all. I think there is still a lot of upside potential in the stock based on what Pfizer is doing." (Yang doesn't own shares of Incyte; Jefferies & Co. doesn't have an investment-banking relationship with the company.)

Since that news, the stock has faded back to the 5 area, below where it traded in the weeks before the Pfizer news. Filling this gap creates a more solid base for future upside movement. After this selloff, any good upside movement will trigger some technical buy signals.

Multiple Incyte insiders, including the CEO, have purchased INCY at higher prices, many at over $7/share. Management has an outstanding history of success with big pharmaceutical companies. CEO Dr. Paul A. Friedman has an excellent track record of developing HIV drugs. When he joined DuPont in 1994 the company was valued at $800 million. The company was sold to Bristol Myers at a valuation of $7.8 billion in 2001. Dr. Friedman also attracted the vast majority of his team to come and work with him at Incyte, with 120 scientists from DuPont now working at the company.

With a lucrative partnership with Pfizer for a portion of its drug portfolio and a strong pipeline of drug candidates, INCY should get plenty of news flow this year to drive the stock price higher. We like INCY in the 5 area for a long-term hold.

Why we think Anglo American (AAUK) will try to buy MMGG's Zinc Deposit

http://www.unquoted.co.uk/forums/showthread.php?threadid=8678&pagenumber=1

"Unfortunately, it did not have the resources to fund these diverse operations and was bought out by one of the majors (Anglo I think) for a knock down price."

Anglo American is now one of the largest natural resource companies in the world, with huge profits and cash flows. They recently changed strategic direction, and will be selling off underperforming assets while increasing their investments in metals such as zinc. Given their huge success with the Skorpion mine, producing zinc for .25/pound and selling over $1/pound now (vs. about .46/pound in 1999 when they bought Skorpion), the blurbs we found (at the bottom of this update) indicate they'll be looking to buy the next Skorpion mine.

With MMGG's zinc deposit being similar in size to Skorpion's, and GTI (the same company that did the feasibility study for Skorpion and took them into production) doing the feasibility study for MMGG, it seems very likely that Anglo American will try to buy MMGG's zinc deposit once the feasibility study's done in about a year. They know the process very well and have done it before very successfully with Skorpion, so it would be a very low risk, high return situation for them. With the zinc shortage becoming more and more obvious as the price of zinc continues higher and zinc inventories keep dropping, other companies will also likely be bidding for MMGG after the feasibility study, possibly creating a bidding war. As the biggest zinc deposit nearing production at likely the lowest cost per pound with all the plans laid out in the feasibility study prepared by the same GTI team that got Skorpion into production, creating almost a turnkey solution, it looks like MMGG will be in the right place at the right time as more and more people understand the zinc supply gap situation...

If MMGG sells their zinc deposit, we'd like to see them hold on to the silver/copper side and develop it, or at least get a good price for it in a transaction.

Here are the indications that Anglo American will be on the lookout for projects like MMGG's zinc mine:

http://www.angloamerican.co.uk/article/?afw_source_key=34C45BAD-090E-483E-AAB1-71E915A67396&xsl_menu_parent=/

"The strong cash flows currently being generated from operations will enable Anglo American to pursue its $5 billion capital expenditure programme and to consider further growth projects."

http://finance.messages.yahoo.com/bbs?.mm=FN&action=m&board=1600684454&tid=aauk&sid=1600684454&mid=2161

Jim Jubak of MSN seems to think it's positive..

Here is the text:

Anglo American (AAUK) is undergoing a restructuring that will eventually involve selling its steel, paper and packaging, and gold mining business. Why invest in a gold mining company that's selling its gold mines? Because Anglo American gets twice the bang for its gold buck by selling its 51% ownership in AngloGold Ashanti over the next year or so. First, the company will sell an underperforming asset at a premium price. AngloGold Ashanti accounted for 8.6% of Anglo American's revenue, but only 4.8% of earnings in 2004. And second, by selling the gold, steel, and paper and packing businesses, Anglo American will free up capital for investing in its other commodity business that produce better returns. The businesses marked for sale make up 45% of invested capital, but generate an average return on invested capital of just 5%, according to Morgan Stanley. Without them, the company's return on invested capital would climb from today's 10.6% to 15.6%. The businesses that will be left for Anglo American to reinvest in are exactly the kinds of hard asset businesses that I'd like to own right now: platinum, diamond, coal, base metals and iron ore. As of Jan. 13, I'm adding Anglo American to Jubak's Picks with a target price of $49 a share by December 2006.

Friday, January 20, 2006

Removing RMBS Sell from Coverage

Tuesday, January 17, 2006

Removing non-Top 5 tech stocks from coverage

We're keeping the tech stocks in our top 5 picks for 2006 on our list, as we're longer term on them. We're also keeping RMBS on our sell list as a hedge on the remaining tech longs.

MMGG Valuation Analysis

Let's look at 3 different ways to value MMGG's zinc mining property:

1. Skorpion mine value -- The Skorpion mine buyout in 1999 valued Skorpion at about $150 million. MMGG's zinc deposit is very similar in size to Skorpion's, and likely has a lower capital cost. With the price of zinc now about double the 1999 price, and with gross profitability for a 25 cent zinc producer being about triple that of 1999, one could guess at a buyout price of 2-3 times the Skorpion buyout price. If the zinc shortage continues to worsen and the zinc price continues higher, MMGG's zinc becomes more valuable. Given approximately 37 million fully diluted shares outstanding after the current financing, such a buyout would be equivalent to about $8-12/share.

2. Multiple of annual earnings -- While it won't be known until the feasibility study is complete, the cost of going into production (building the mine and extraction plant) has been estimated at between $250 and $400 million (Skorpion was over $450 million). Assuming $400 milliion is needed, and is financed with 60% bank debt financing (standard with a bankable feasibility study) and 40% equity financing, 40-50 million shares of dilution would be required at a stock price of $3.20-$4/share (a 50% joint venture for someone to provide only 40% of the cost to go to production would be even better for shareholders). Assuming an 11-year life of the plant, 180 million metric tons/year processed, a 25 cents/pound cost to produce zinc, and the current .9366 price of zinc, annual revenues would be over $370 million, gross profit over $270 million, and annual earnings (before taxes) of well over $200 million. A 4x multiple would result in a stock price over $10 while a 5x multiple would result in a stock price over $15. Discounting the 4x multiple back 15%/year for 3 years to production would result in approximately a $7 stock price, while discounting the 5x multiple back 10%/year for 3 years would result in approximately an $11 stock. This method results in approximately a $7-11/share estimated value.

3. Present value of earnings stream -- MMGG's management is negotiating with Mexico (for the mine) and other countries (for the extraction plant) for tax breaks. The present value of an earnings stream of 80% (to net out taxes) of the earnings calculated in #2 above over 11 years using a 15% discount rate is nearly $1 billion, or about $12.50/share. Using a 10% discount rate results in nearly $16/share. Discounting further by 15%/year and 10%/year, respectively, over 3 years to get to production results in approximately a $8-12/share estimated value.

All 3 of the above methods result in a share price after the feasibility study of about $7-12. The over 1.5 billion pounds of zinc in the Smithsonite manto should add significantly to MMGG's value, probably extending the life of the plant by several years. If the silver/copper side of MMGG turns out to be more valuable than the zinc side, MMGG could be worth more than $25/share, especially if the prices of zinc, silver, and copper continue higher.

Lots of assumptions are built into the above calculations, so take them with a grain of salt. However, many of the uncertainties will be removed during the completion of the feasibility study over the next year or so, and the numbers will become clearer to all. Some may be better than assumed and some may be worse. However they turn out, it looks like MMGG at the current price level is extremely undervalued and poised to move much higher.

Wednesday, January 11, 2006

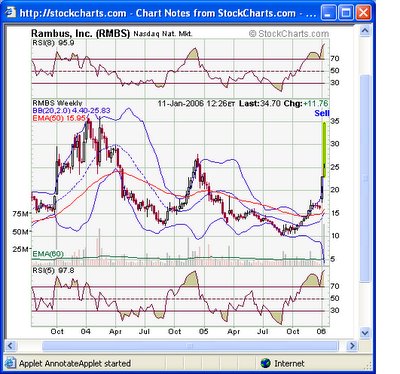

RMBS Sell Opportunity

Rambus (RMBS) is trading up over 22% today to near $35 after a WR Hambrecht upgrade to Buy from Hold with a year-end target of $38. The judge in a lawsuit against Hynix last week rejected Hynix's request to dismiss the case on grounds that Rambus had allegedly destroyed evidence, causing the stock to gap up from the 18's to the 22's. The upgrade assumes RMBS wins not only the current Hynix case, but also patent infrigement cases against Micron and Samsung, as well as their price-fixing case against Micron, Hynix, Samsung, Infineon, and Siemens. In addition, the analyst for some reason applies a 3x sales multiple to the potential litigation proceeds, thus assuming $27/share should be added to the stock price as a result of the litigation.

Because the Hynix trial isn't scheduled until March, and the price-fixing trial date hasn't even been set yet, we believe assuming RMBS wins these trials and collects royalties from all of them this year, and valuing those wins into the stock now is faulty analysis. In addition, technically, the stock is very overextended, having more than doubled on the year already. With resistance from 2 years ago in the $36 area, the weekly Upper Bollinger Band at $25.69, 8-week RSI near 96 and 5-week RSI near 98 (max theoretical is 99.99), we think the current price provides an excellent sell point or sell short opportunity (to hedge our long positions). We expect at least a retrace in the short term and likely much lower levels longer term. RMBS is currently trading at a forward PE ratio of around 140.

Tuesday, January 10, 2006

AAPL Breakout on Continued Impressive Performance

While the stock has rocketed over the last 2 years, currently trading at an all-time high, AAPL's performance has similarly rocketed, as Jobs and co. continue to impress and beat analyst expectations. The huge revenue growth announcement and other initiatives combined with the breakout to new highs should propel AAPL to even higher levels in coming weeks.

Saturday, January 07, 2006

MMGG Update

The biggest issue Metalline Mining had 2 weeks ago was getting financing to retain GTI to complete the feasibility study. Now, with this rally, big investors have jumped on the private placement, as they get an immediate 50%+ increase as well as the warrants. Closing this financing will mean a huge risk will be removed, as they'll have enough cash to complete the feasibility study with the team that's done it before at Skorpion, and they may have extra cash to expedite the development of the silver/copper deposit.

We didn't go into the silver/copper side much in the first report, but one seasoned industry investor who has invested in dozens of different mining private placements over the years told Great Trades that he likes the silver/copper potential even more than the zinc potential. Metalline Mining has essentially ignored the silver/copper side since 1999 when the Skorpion mine feasibility study was completed, but it used to be their primary focus. Since then, the price of silver has almost doubled and the price of copper has tripled, both up more than zinc. Most of the current investors probably have no idea there is any silver/copper deposit, as all the focus has been on zinc.

If the work they restarted recently on the silver/copper side indicates economic value, as the original samples did when prices were much lower in 1999, that should provide a major boost to MMGG's stock price. Watch the news over the coming months to see if they get any good silver/copper results.

Friday, January 06, 2006

RIMM Breakout from Trading Range

On December 21, RIMM "reported a stronger-than-expected 33 percent rise in third-quarter profit on Wednesday, as sales jumped on surging demand for its popular BlackBerry wireless e-mail device." The report "calmed investor fears that the company's patent fight with NTP Inc. was causing major customer losses." "In spite of all this noise, customers are still definitely buying in North America, and they're really, really buying internationally," RIM Co-chief Executive Jim Balsillie said.

Despite its relatively high price and market cap, RIMM is not an expensive stock, trading at a forward PE of around 20 on expected long-term 20% growth. If the NTP case gets resolved, that would remove lots of uncertainty from RIMM customers and should increase their numbers. In addtion, lots of inexperienced short sellers have sold RIMM short, expecting the service to be shut down based on all the media hype. These short sellers will have to buy back to cover their short positions, helping to force the price higher.

In the worst case, if the court rules that RIMM has infringed on NTP's patents and can't use email like they currently do, RIMM says they have a workaround that will keep it in service.

With RIMM breaking out of its recent trading range and closing at a 3-month high of 69.19, over its 200-day exponential moving average, it looks ready for a rally and short squeeze to higher levels.

Wednesday, January 04, 2006

BTU Breakout after Mine Tragedy

The below chart shows the consolidation over the last few months under the 86.95 resistance. In October and December, BTU was turned back from this level. Today, it has broken out above this level, which should produce a nice rally in coming weeks.

Tuesday, January 03, 2006

Top 5 Picks for 2006

Metalline Mining (MMGG, $0.98)

As highlighted earlier today, MMGG is a steal in the $1 area.

Chinese Techfaith Wireless (CNTF, $13.49)

CNTF should move much higher if they don't horribly fail on their 100% revenue growth target. Currently trading at a PE under 15. Highlighted in December.

Orckit Communications (ORCT, $24.38)

ORCT remains undervalued and has huge growth potential if they get any new customers. Highlighted in December.

Omnivision Technologies, Inc. (OVTI, 19.96)

Extremely undervalued tech stock highlighted as Complete Growth Investor's #1 pick for 2006 today.

Meadow Valley Corp. (MVCO, 11.58)

Extremely undervalued construction services company that should benefit greatly from the new Federal Highway Bill. Highlighted in December.

Others

JER Envirotech (JER.V in Canada, $1.12 CAD), a Wood Plastic Composite (WPC) manufacturer, is one of our favorite emerging growth stocks, as it should grow tremendously, especially with China and India adding to the worldwide demand for materials. However, most U.S. investors can't buy JER, as it's only listed in Canada.

Delek Resources (DLKR, .20) is a speculative oil explorer that will skyrocket if they can produce oil this year. They'll be drilling early on after some extensive delays. At .20, it has a lot of upside, as it hit nearly $1 when a nearby driller initially reported an oil strike only to later disappoint by reporting insufficient quantities to be commercially viable. DLKR is too speculative to make the top 5 list, but has an extremely high potential % return if they get a good hit.

OVTI CGI's Top Pick for 2006

-OVTI has a maket cap of $940M-As of the end of last quarter (Jan.), the company had $315M in cash and equivalents and no debt. That's right, the company is trading for less than 3x its cash position. And with cash on hand, there is simply no possibility that the company is pulling any kind of Enron shenanigans to artificially inflate earnings.

-In the first three quarters of fiscal 05, the company has had cash flows of $100M, so that gives a run rate of ~$133M. On an enterprise value to cash flow basis (not FCF), this gives a ratio of 4.6, which indicates a very, very cheap stock. FCF for the trailing twelve months was $110.8M, giving a EV/FCF ratio of \n5.5 (still unbelievably cheap).

-The company's trailing PE is 13, and if the cash and equivalents are backed out, it is 8.7. Analysts estimate a growth rate of 25% for the company for the next five years, giving a PEG ratio of .51 for the company. Compare this with an average PEG ratio of \n1.42 for the semiconductor industry (which clearly includes a number of different type of chip/sensor producers, but has few companies that specialize in areas with expected growth rates anywhere near that of the camera phone, security, and automobile sensor markets) and \n1.51 for the S&P 500.

-To sum it up, OVTI is a severely undervalued, highly profitable, rapidly growing tech company in a hyper-growth market with a potential technology that could possibly significantly limit the competition.

Metalline Mining (MMGG) for the long term

From the Metalline Mining Web site (http://www.metalin.com/zinc_solvent.html) :

“Zinc is one of the most useful and essential metals. Zinc's primary use is corrosion protection in the galvanized steel industry. The recycle life of galvanized steel can be up to 100 years and the added cost is justified by decreased maintenance cost over ungalvanized steel.

The largest use of galvanized steel is in the automobile industry and in commercial and residential construction. Construction is zinc's fastest growing sector where it is used, for Structural support, as galvanized electric power, microwave, cellular and other towers, steel beams, floor joists, studs and trusses and it is used in ductwork, roofing and decorative interior and exterior covering.

Die cast zinc parts are used in automobiles, appliances, tools and computers.

Zinc alloys with copper, tin, lead, aluminum and magnesium are used in the construction, automotive, electrical and consumer products industries. Other zinc uses are in batteries, tires, rubber goods, paint pigments, ceramic glazes, cosmetics, pharmaceuticals and chemicals.

Zinc is an essential nutrient for all life, plant and animal and is used in the food industries, nutritional supplements, animal feed and fertilizers.

Zinc consumption has grown dramatically over the past 30 years and continues to increase and new uses for zinc are being developed. Zinc fuel cells are under development for generating electricity and could create significant new demand.”

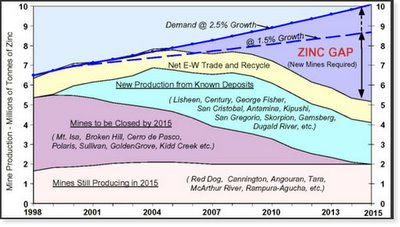

Zinc Supply Gap

Following several decades of ample zinc supply, a major supply gap is developing in the zinc markets that will likely have a profound impact on future zinc exploration and mine development (from http://www.yukonzinc.com/zincMarkets.htm):

China has been a main driver behind the supply gap, as they’ve gone from a major exporter of refined zinc to a major net importer in 2005.

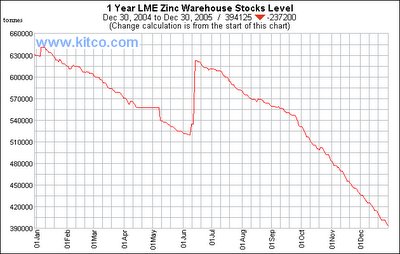

As you can see from the below chart, the London Mercantile Exchange Zinc Warehouse Stocks Level decreased by over 37.5% in 2005, indicating the zinc shortage is getting worse quickly (live zinc charts at http://www.kitcometals.com/charts/ZINC_historical.html):

As the zinc supply shortfall worsens and inventories continue to decline, the price of zinc increases. You can see from the below chart that the price of zinc has more than doubled in the last 18 months:

Unlike other commodities, there are few giant zinc deposits in inventory to fill the gap due to depletion of reserves during the past several years of low zinc prices. While old reserves get depleted, no new large zinc mines are set to come into production in the next two years.

Metalline Mining Zinc

The Skorpion mine in Namibia, Africa, is the 8th largest zinc mine in the world. In 2003, the Skorpion mine became the first mine to use the Solvent Extraction Electro-Winning (SXEW) to produce refined zinc from oxide zinc. The cost of producing refined zinc by SXEW is $0.25 per pound, a 30% advantage over the rest of the zinc industry, which produces zinc from a sulfide concentrate through the smelter process at a cost of $0.35 per pound. This new technological advance has made Skorpion the world low cost zinc producer.

Using the same SXEW process as the Skorpion mine, Metalline Mining’s Sierra Mojada mine in Mexico could be one of the world’s 10 largest zinc mines and one of the lowest cost producers (and possibly the lowest cost producer). With a similar cost to Skorpion’s $0.25 per pound, Metalline would have a margin of over $0.60 per pound at the current zinc price of over $0.85 per pound ($0.85-$0.25=$0.60). With the price of zinc likely headed much higher given the aforementioned supply gap situation, the profit potential for Metalline’s zinc reserve is enormous.

Feasibility Study

After discovering mineralization and doing extensive drilling to show the presence of enough marketable metals to move forward, mining companies go through a feasibility study, a process to define the metals reserve (metallurgy), define the costs and profitability, get regulatory approvals, and design the mine (and refinery/extraction plant in cases where that step is included). The feasibility study provides the extensive proof that the mine will make money, and is used for financing to go into production. Typically, this financing comes from a takeover by a major mining company, a joint venture with such a company, or a combination of bank debt financing and equity financing.

Metalline Mining began the feasibility study process about a year ago, proving they had over $4 billion of Zinc earlier this year in the metallurgy portion. The feasibility study has stalled in recent months because of a lack of funding, which Metalline is addressing with the current private placement. Once the financing is complete (likely in the next couple of weeks), the feasibility study should be complete within 9 months to a year. The cost of building a mine and extraction plant is likely to be in the $250 million to $400 million range.

To conduct the feasibility study, Metalline selected Green Team International (GTI), the same company that conducted the feasibility study on the Skorpion mine. GTI designed, supervised the construction, and operated the Skorpion mine and extraction plant through initial production and until the mine and plant were at 90% capacity. Given Metalline's plan to use the same efficient, cost-saving process as Skorpion, GTI was the perfect choice.

Once the company raises the money required to complete the feasibility study, most of the risk for MMGG will be gone. The remaining part of the feasibility study is mostly defining the costs and profitability. Once that’s complete, virtually all the risk will be gone, and MMGG will likely have several takeover bids to fall back on as the worst-case scenario, with the most lucrative path to move to production with debt and equity financing (at a much higher stock price). Skorpion was bought out by Anglo American (AAUK) at the completion of their feasibility study, resulting in a huge profit for Reunion Mining shareholders even though the price of zinc was near a bottom, much lower than current prices. Anglo American is one likely bidder for MMGG at the completion of the feasibility study.

Valuation Based on Zinc Alone

With nearly 5 billion pounds of zinc, a $0.60 per pound margin would mean nearly $3 billion of gross profits for Metalline Mining. Even if the initial costs are in the $400 million range for the mine and extraction plant and you discount heavily for the approx. 3-year wait to get into production and the profits coming over 10-12 years, MMGG is still extremely undervalued at its current market cap under $30 million. Earnings per year once in production should be several times the current market cap. Metalline's zinc reserve alone is worth over 100 times its current market cap.

Company insiders, recognizing the long-term value, have bought MMGG shares between $1 and $1.66 over the last few years, and none of the current management has sold.

Any way you look at it, MMGG is severely undervalued based on the zinc opportunity.

Private Placements Depress Share Price

Metalline Mining initiated a private placement at $1/share over 2 years ago to raise capital for the reserve definition and feasibility study. Many of those private placement investors sold their shares as the lockup expired beginning in late 2004, pressuring the stock price over the last 15 months. Despite the fundamentals improving dramatically since then, with the price of zinc nearly doubling along with the successful completion of the metallurgy portion of the feasibility study, the stock price has lost most of its value from over $3 in October 2004 because of this selling.

Early in 2005, Metalline Mining attempted to finance the rest of the feasibility study with a private placement at $1.50 per share. However, the aforementioned profit-taking investors and big investors who wanted to get private placement shares cheaper sold, pressuring the stock down to $1.50 after starting the year at $2. Metalline was forced to lower the private placement price to $1.125, after which the stock again sold down to the private placement price. Big investors insisted on a still lower price for the private placement, so the placement price was lowered to .80, with a $1.25 warrant. Yet again, the stock sold down to the new private placement price, as investors sold their old shares to get the new shares and the warrant. Now that the private placement is coming to a close, this selling pressure along with tax-loss selling has decreased. This private placement should get them through the rest of the feasibility study.

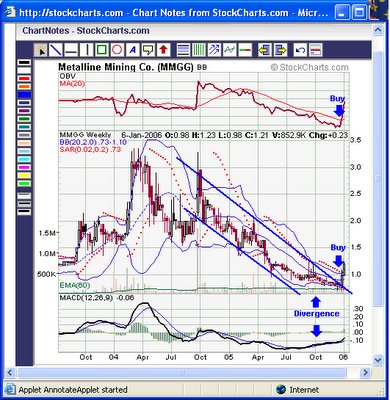

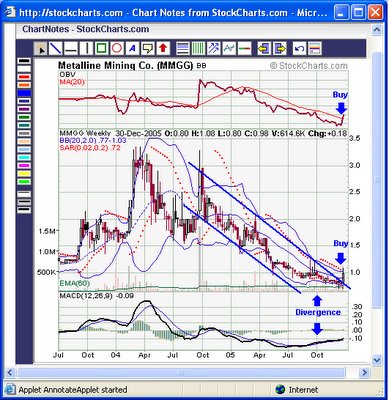

Rally Last Week on Big Volume – Buy Signals

With zinc hitting a 16-year high, other zinc exploration stocks like Canadian Zinc and Yukon Zinc have run up over 75% in recent weeks on big volume. MMGG had been lagging because of the aforementioned reasons, but finally began to join the zinc stock rally last week. MMGG rallied 22.5% last week from a 6-year low on the highest volume since it hit $3.28 on October 1, 2004, even though it was a holiday-shortened week and some investors must have been tax-loss selling into the rally.

Last week’s rally triggered some technical buy signals on the MMGG weekly chart:

With the volume increase and accompanying price increase, an On Balance Volume (OBV) buy signal was triggered last week. You can find out more about OBV here: http://stockcharts.com/education/IndicatorAnalysis/indic-obv.htm.

After months of bullish divergence between MACD and the stock price, with the MACD increasing from its summer low while the price continued lower, MMGG also finally broke out of its 15-month downtrend channel last week. This break from the channel triggered a Parabolic SAR buy signal. You can find out more about Parabolic SAR here: http://stockcharts.com/education/IndicatorAnalysis/indic_ParaSAR.htm.

These technical analysis buy signals indicate that MMGG has seen its bottom and is likely to continue higher in coming weeks and months.

Metalline Mining Silver/Copper

In addition to the zinc reserve currently in the feasibility stage, Metalline Mining also has high-grade silver and copper mineralization on the North side of its Sierra Mojada property. Metalline’s Sierra Mojada property has very unusual geology (http://www.metalin.com/geology.html), with 2 distinct mineral systems: high zinc mineralization on the South side of the Sierra Mojada fault and high silver and copper mineralization on the North side. Over 5000 samples had been collected from the North side through 1999, indicating very high grade silver and copper mineralization. In 1999, with the positive feasibility study from Skorpion, Metalline shifted its focus to the enormous potential of its zinc mineralization, putting the silver/copper exploration on hold.

With GTI hired to do the feasibility study, Metalline staff has been able to again give the silver/copper mineralization some attention. Over 2000 new samples have been collected, the results of which should be available shortly. If the results continue to be good, the silver/copper side of MMGG could have as much or more potential than the zinc side. Up to this point, Metalline had not actively promoted the silver/copper side of their property.

Future Plans

Metalline management recognizes that there are two areas that need improvement. First, as a bulletin board stock, they’ve had difficulties attracting big investors, many of whom won’t invest in bulletin board stocks. Look for them to pursue a Toronto or Amex listing, which would give them more credibility and open up doors to a high number of large investors. Secondly, look for them to significantly increase the marketing and PR efforts, possibly hiring a PR firm or two to help them in that area. The lack of news and promotion combined with the private placement sellers hurt the stock last year.

Conclusion

Given the extremely low valuation versus the enormous zinc opportunity, MMGG, trading at less than 1% of the proven value of their zinc reserve, should be several times higher after they complete the feasibility study. If the results from their recent silver/copper sampling continue to be positive, that will also help the stock move significantly higher. At the current level under $1, MMGG looks like a steal, and anything under $2 also looks like a great value with huge upside for the long term.

Archives

December 2005 January 2006 February 2006 March 2006 April 2006 May 2006 July 2006 August 2006 October 2006 November 2006 December 2006 January 2007 February 2007 March 2007 April 2007 May 2007 June 2007 August 2007 October 2007 November 2007 May 2008 September 2008 October 2008 January 2009 February 2009 March 2009 April 2009 May 2009 June 2009 July 2009 August 2009 September 2009 October 2009 November 2009 December 2009 March 2010 May 2010 June 2010

Great Trades Home Email GreatTrades

Great Investments Blog Great Investment Articles BlogDisclaimer: Great Trades may have a position in all or some of the stocks discussed in this blog, but is not paid by any company to promote their stock. Great Trades contains opinions, none of which constitute a recommendation that any particular security, transaction, or investment strategy is suitable for any specific person. Great Trades does not provide personalized investment advice.